Strong Performance for Global Air Freight Markets

3-minute read

Demand for air cargo increased by 6.9% in 2021, compared to 2019 (pre-COVID levels) and 18.7% compared to 2020, following a strong performance in December 2021, according to IATA data for global air freight markets.

This was the second biggest improvement in year-on-year demand since IATA started to monitor cargo performance in 1990 (behind the 2010s 20.6% gain), outpacing the 9.8% rise in global goods trade by 8.9 percentage points.

“Air cargo had a stellar year in 2021. For many airlines, it provided a vital source of revenue as passenger demand remained in the doldrums due to COVID-19 travel restrictions,” said Willie Walsh, IATA’s director-general.

“Growth opportunities, however, were lost due to the pressures of labour shortages and constraints across the logistics system. Overall, economic conditions do point towards a strong 2022.”

As comparisons between 2021 and 2020 monthly results are distorted by the extraordinary impact of COVID-19, unless otherwise noted, all comparisons below are to 2019, which followed a normal demand pattern.

• Global demand in 2021, measured in cargo tonne- kms (CTKs*), was up 6.9% compared to 2019 (7.4% for international operations).

• Capacity in 2021, measured in available cargo tonne- kms (ACTKs), was 10.9% below 2019 (-12.8% for international operations). Capacity remains constrained with bottlenecks at key hubs.

• Improvements were demonstrated in December; global demand was 8.9% above 2019 levels (9.4% for international operations). This significantly improved from the 3.9% increase in November and the best performance since April 2021 (11.4%).

• Global capacity was 4.7% below 2019 levels (6.5% for international operations).

• The lack of available capacity contributed to increased yields and revenues, providing support to airlines and some long-haul passenger services in the face of collapsed passenger revenues. In December 2021, rates were almost 150% above 2019 levels.

• Economic conditions continue to support air cargo growth.

• Global goods trade rose 7.7% in November (latest data), compared to pre-crisis levels. Global industrial production was up 4.0% over the same period.

• The inventory-to-sales ratio remains low. This is positive for air cargo as manufacturers rapidly turn to air cargo to meet demand.

• The cost-competitiveness of air cargo relative to sea-container shipping remains favourable.

• The recent surge in COVID-19 cases in many advanced economies has created strong demand for PPE shipments, usually carried by air.

• Labour shortages, partly due to employees being in quarantine, insufficient storage space at some airports and processing backlogs continue to put pressure on supply chains.

• The December global Supplier Delivery Time Purchasing Managers Index (PMI) was 38. While values below 50 are generally favourable for air cargo, in current conditions, it points to delivery times lengthening because of supply bottlenecks.

Regional Performance

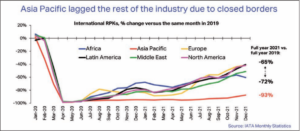

Substantial variations were evident in the regional performance of air cargo in 2021 compared to 2019.

North American carriers were the strongest performers, reporting an annual increase in international demand of 20.2%.

The Middle East and African carriers also reported double-digit growth in international demand in 2021 (10.6% and 11.3%, respectively) compared to 2019.

Asia-Pacific and European carriers saw international demand rise 3.6% in 2021 compared to 2019.

Latin American carriers were the only ones to record a contraction in international demand of 15.2% compared to 2019.

Asia-Pacific airlines reported a rise in international demand of 3.6% in 2021 compared to 2019 and a fall in the international capacity of 17.1%.

In December, airlines in the region posted an 8.8% increase in international demand compared to 2019.

Demand for goods manufactured in the region remains strong, including PPE. International capacity remained constrained in December, down 10% compared to the same month in 2019.

Source: The New Zealand Shipping Gazette

P.S. Easy Freight Ltd helps New Zealand importers & exporters to save money on international freight and reduce mistakes by guiding how to comply with Customs and biosecurity rules.

➔ Contact us now to learn how we can assist you.