Record Air Cargo Demand Outperformed Pre-COVID Levels

3-minute read

Supply chain disruptions have been among the key stories during the pandemic. Congestion and lack of capacity have led to large increases in shipping prices. But for importers & exporters, the different modes of transport are not always a perfect substitute.

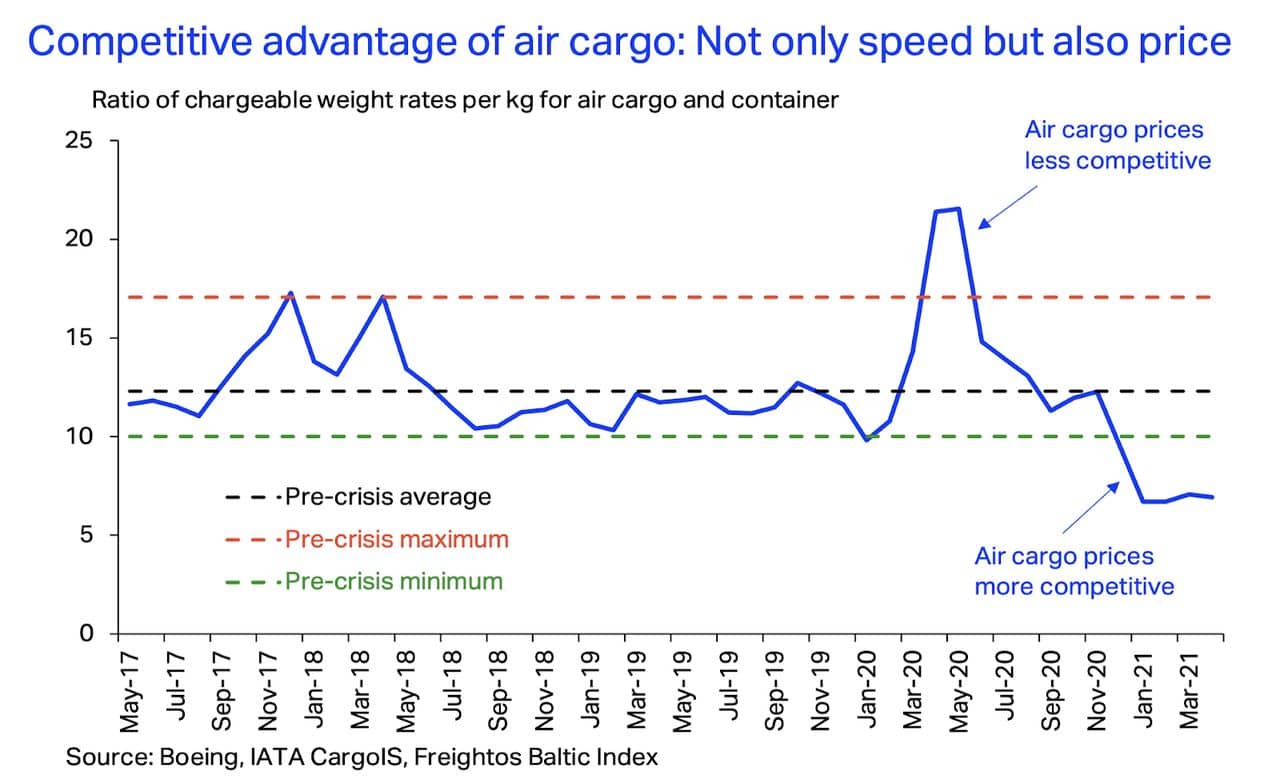

They have different characteristics, and their prices diverge accordingly. Air cargo, for example, allows fast shipping but had been roughly 12 times more expensive than ocean trade in the 2-3 years prior to the crisis.

The ratio shown on the chart compares air cargo and ocean freight rates per kg of chargeable weight, assuming 9 tonnes per 40-feet container.

Since mid-2017, the ratio of prices had been trending in the range of 10 and 17. It spiked in Q2 2020, due to the grounding of the passenger fleet and strict lockdowns at that time – air fares were roughly 85% above pre-crisis values in Q2.

The International Air Transport Association (IATA) released the latest April 2021 data for global air cargo markets showing that air cargo demand continued to outperform pre-COVID levels (April 2019) with demand up 12%.

As comparisons between 2021 and 2020 monthly results are distorted by the extraordinary impact of COVID- 19, all comparisons to follow are to April 2019 which followed a normal demand pattern.

While air cargo fares remained elevated, container fares have increased strongly since then, and were more than three times higher than pre-crisis levels in April 2021.

As a result, the relative price of air cargo vs ocean declined, supportive for air mode of transport. In Q1 2021, air cargo has grown 5.6% compared to Q1 2019, while container throughput increased by 6.1%.

In contrast, in Q2 2020, when air cargo fares were close to 20 times those of containers, air cargo was relatively weaker. (Air freight traffic down 17.5% year-on-year in Q2, container throughput down 7.8%).

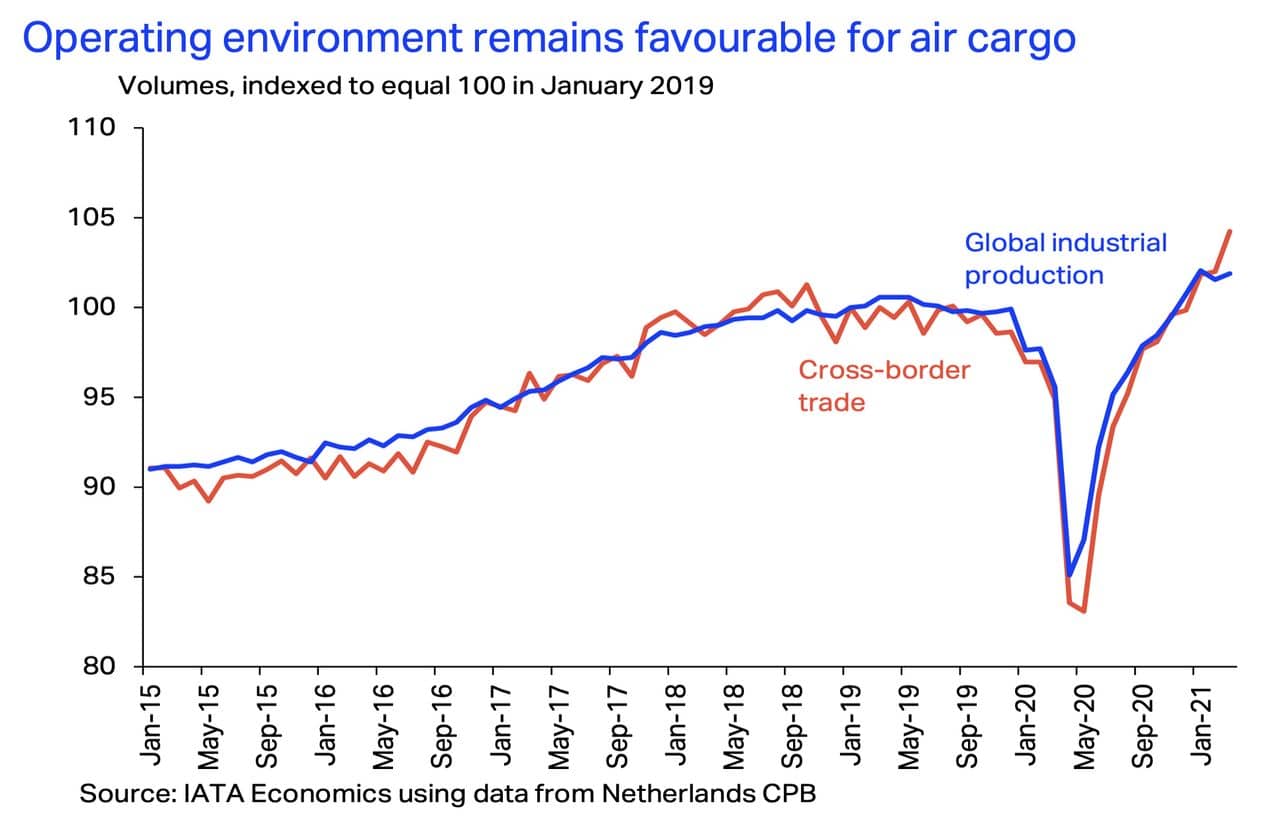

Air cargo also tends to overperform other means of transport at the start of an economic upturn due to restocking cycles, when businesses turn to air to rapidly refill inventories as demand rises.

But with strong consumer demand and the lack of container capacity expected to continue until late 2021 at the earliest, air cargo is likely to remain a viable alternative to container shipping for some businesses.

The upshot is that air cargo is likely to continue to perform well compared to other modes for most of 2021.

Competitiveness against sea shipping has improved. Air cargo rates have stabilized since reaching a peak in April 2020, while shipping container rates have remained relatively high in comparison.

Meanwhile, longer supplier delivery times as economic activity ramps up make the speed of air cargo an advantage by recovering some of the time lost in the production process.

Looking ahead, the WTO (The World Trade Organization) expects global goods trade volumes to grow 8.0% in 2021. Even with the low base around Q2 2020, this will continue to support air cargo.

Together with the inventory restocking cycle, backlog of orders, increased attractiveness of air cargo and improving air cargo capacity, that makes many good reasons for air cargo to remain strong in 2021.

This should continue to support airlines in the period ahead, as passenger markets remain weak. Indeed, IATA anticipates air cargo revenues to reach a record-high $152bn in 2021, up ~19% versus 2020.

SOURCE: IATA

P.S. Easy Freight Ltd helps New Zealand importers & exporters to save money on international freight and reduce mistakes by guiding how to comply with Customs and biosecurity rules.

➔ Contact us now to learn how we can assist you.