Sea Freight Price Predictions for 2021 (What & Why!)

3-minute read

There are some large question-marks forming over the momentum of shipping freight rates and whether these will taper back when normality returns to international supply chains. Or have higher rates become the newest ‘new normal’?

Surging freight rates since the middle of 2020 have continued into 2021 and look likely to become hardwired into the supply chain for containerised freight.

As users of trade lanes have blinked again-and again at rising spot rates, the earnings curves of the shipping sector have turned strongly upwards, erasing the lagoons of red ink of recent years.

Extreme spot rates in container shipping have lasted for months now. On some routes, rates will rise again this month, says the London maritime consultancy Drewry.

Drewry believes that we should start using the term “extreme” to more accurately define this period of freight rate development, rather than the somewhat tired and overused term “unprecedented”.

Shanghai-Los Angeles and Shanghai-New York rates have been in the “extreme” zone since Q3 2020, the Shanghai-Rotterdam and Shanghai-Genoa since Q4 2020 and Rotterdam-Shanghai entered the “extreme” zone in Q1 2021 and are just about to reach the 3-month threshold.

Drewry shows that the number of Asia-to-Europe/Mediterranean cancelled sailings will jump to nine sailings during week 18, following the delays caused by the Suez Canal blockage.

This means that 6% of scheduled sailings will not happen. Drewry predicts that Asia-to-Europe spot rates will rise again, having declined slightly for several weeks (but remaining at “extreme rate” levels).

There is also a phenomenon of contagion, where extreme freight rates spread from trade route to trade route.

“This happened last year, when extreme rates on the trans-Pacific spot market were followed by extreme rates on Asia-Europe,” said Philip Damas Drewry head of supply chain advisors.

“There is strong evidence that the trans-Atlantic trade spot market is next in line. “Port congestion at US ports, combined with container equipment shortages, reduce the supply side of the market.

“Price is also driven by carrier expectations, as they are able to make a fortune on the other trade routes and look for a price incentive to allocate scarce equipment to trade routes like the trans-Atlantic and Europe-to-Asia.”

Is there an end of disruptions and rate increases? Drewry maintains that spot rates will fall in 2022. Their rationale is that the current extreme freight rates are driven by a big increase in traffic volumes coinciding with large operational disruptions to the port and vessel networks.

Drewry expects these operational disruptions, port congestion and equipment shortages to decline substantially during Q4 2021.

“We do not believe that the problem will go away materially during Q3, because the industry will then have to handle extra peak season volumes,” they say.

“Therefore, based on available insight and industry dynamics, our opinion and forecast is that “extreme freight rates” will last for at least another 3-5 months.

“If correct, this means that such extreme freight rates will have lasted for more than a year on the transPacific and some 10 months on AsiaEurope.”

For carriers, this means a profit bonanza. In the past two weeks, there are reports of stunning improvements in profitability. Drewry believes that carriers are set up for at least another two years of “extreme” profits.

“For shippers, this means that spot rates should be avoided at all costs, if there are alternatives. As “extreme” rates become a medium-term issue, some shippers will also consider sourcing from locations requiring less expensive transport costs.”

Drewry definition:

“Extreme freight rates” are rates which are at least 50% higher than the 5-year historical average, provided they last for at least three months (so as not to confuse them with peak-season freight or one-off rates).

Detailed assessment for Thursday, 6 May 2021

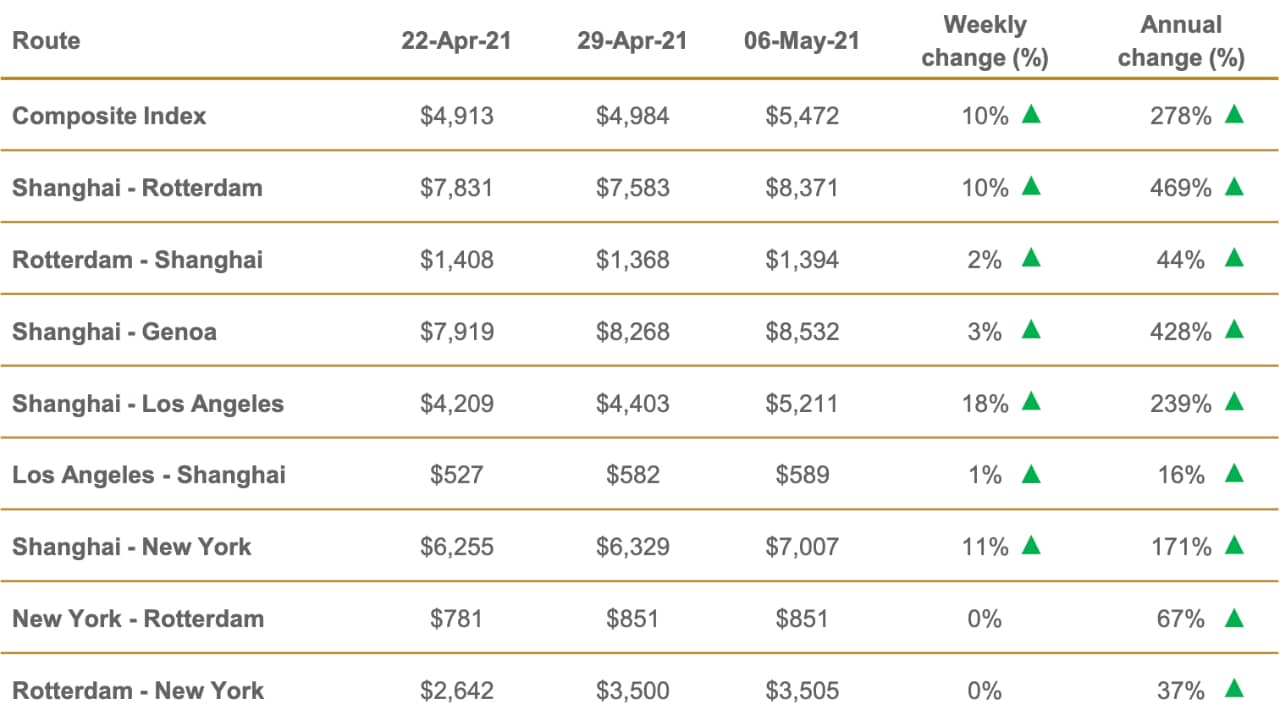

The composite index increased 9.8% or $489 this week, and also, remains 278.4% higher than a year ago.

The average composite index of the WCI, assessed by Drewry for year-to-date, is $5,110 per 40ft container, which is $3,272 higher than the five-year average of $1,838 per 40ft container.

Drewry’s composite World Container index increased 9.8% or $489 to $5,472.33 per 40ft container.

Freight rates on Shanghai-Los Angeles gained $808 to $5,211 for a 40ft container and those on Shanghai-Rotterdam rose $788 for a 40ft box. Likewise, rates on Shanghai-New York surged $678 to $7,007 per 30ft.

Also, rates on Shanghai-Genoa grew $264 to $8,532 for a 40ft container and those on Rotterdam-Shanghai inched up $26 to $1,394 for a 40ft box. We expect the index to remain stable next week.

Source: NZ SHIPPING GAZETTE, Drewry

P.S. Easy Freight Ltd helps New Zealand importers & exporters to save money on international freight and reduce mistakes by guiding how to comply with Customs and biosecurity rules.

➔ Contact us now to learn how we can assist you.