What’s Happening in the Air Freight Market

3-minute read

The International Air Transport Association (IATA) released data for November 2023 global air cargo markets, indicating the strongest year-on-year growth in roughly two years.

This is partly due to weakness in November 2022 but also reflects a fourth consecutive month of strengthening demand for air cargo.

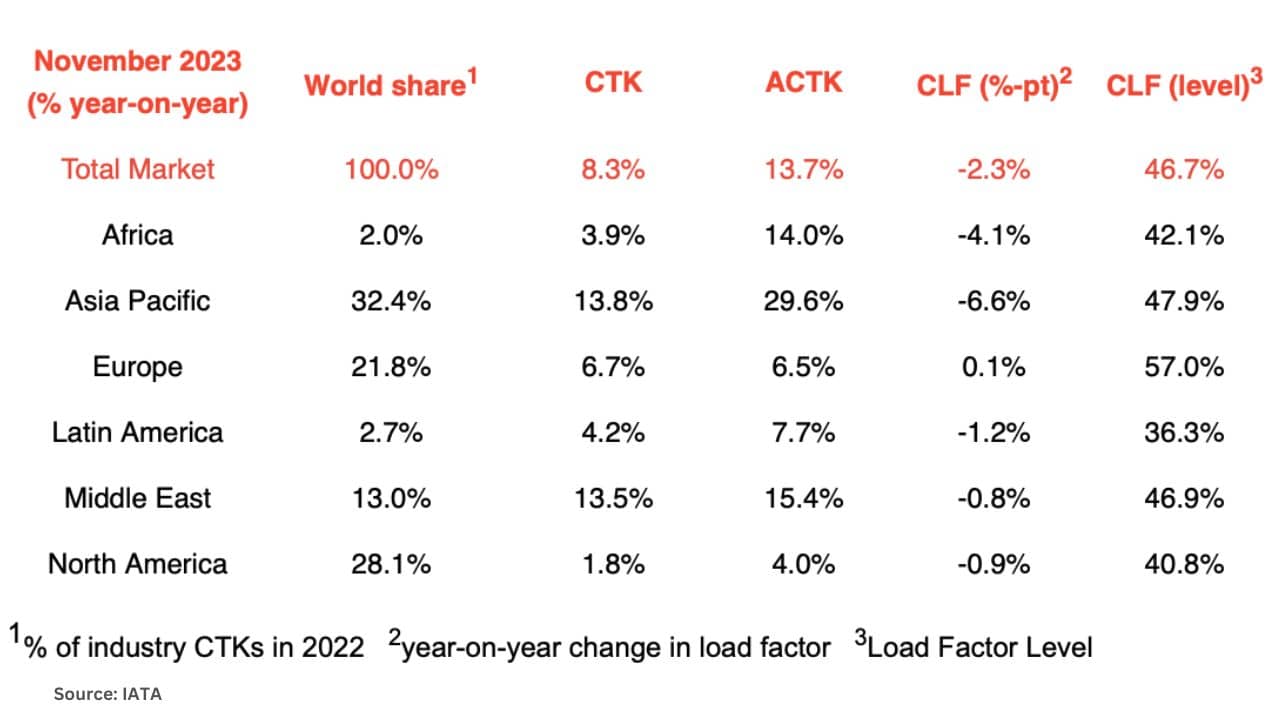

- Global demand for air cargo, measured in cargo tonne-kilometres (CTKs), increased by 8.3% compared to November 2022. For international operations, demand growth was 8.1%.

- Capacity, measured in available cargo tonne-kilometres (ACTKs), was up 13.7% compared to November 2022 (+11.6% for international operations).

Most of the capacity growth continues to be attributable to the increase in belly capacity as international passenger markets continue their post-COVID recovery.

Compared to November 2019 (pre-COVID-19), demand is down 2.5%, while capacity is up 4.1%.

Some indicators to note include:

• Both the manufacturing output and new export order Purchasing Managers Indexes (PMIs) – two leading indicators of global air cargo demand—continued to hover just below the 50-mark in November, with small positive movements indicating a deceleration of the economic slowdown.

• Global cross-border trade recorded growth for the third consecutive month in October, reversing its previous downward trend.

• Inflation in major advanced economies continued to soften in November as measured by the corresponding Consumer Price Index (CPI), centering around 3% year-on-year for the United States, Japan, and the EU.

In the meantime, China exhibited negative annual growth in its CPI for the second time in a row.

• Air cargo yields (including surcharges) continued their significant upward trend (+8.9% since October). Rising yields are in line with improving air cargo load factors over recent months. This could be tied in part to booming e-commerce deliveries from China to Western markets.

“November air cargo demand was up 8.3% on 2022—the strongest year-on-year growth in almost two years. That is a doubling of October’s 3.8% increase and a fourth month of positive market development. It is shaping up to be an encouraging year-end for air cargo despite the significant economic concerns that were present throughout 2023 and continue on the horizon,” said Willie Walsh, IATA’s Director General.

Asia-Pacific Regional Performance saw air cargo volumes increase by 13.8% in November 2023 compared to the same month in 2022.

This performance was significantly above the previous month’s growth of 7.6%.

Available capacity for the region’s airlines increased by 29.6% compared to November 2022 as more belly capacity came online with the removal of COVID-19 restrictions.

Anticipated Surge in Air Freight Rates

IATA’s data is understandably lagging by about two months and does not encompass the current Red Sea crisis or the anticipated shift in volumes from ocean to air.

According to The Loadstar, shippers are considering a targeted use of airfreight to address the rising delays resulting from the Red Sea crisis.

Despite disruptions at sea, current airfreight data does not indicate any significant shifts in rates. However, this situation is anticipated to change in the upcoming week.

Niall van de Wouw, Chief Airfreight Officer for Xeneta, explained to the Loadstar that the delays in the Red Sea haven’t yet affected rates, but such an impact is expected.

He explained that the previous week, being the one following the new year is typically slow. Nevertheless, there is a noticeable trend of shippers transitioning to airfreight.

Mr. van de Wouw mentioned that this shift to airfreight would likely be evident in rates in the coming week. He added that it would take some time for goods to reach the hands of forwarders, emphasizing the observable shift from sea to air.

A forwarder in Southeast Asia concurred to the Loadstar that the disruption hasn’t yet influenced airfreight rates significantly.

He explained that there is a slight increase, but the price difference between air and ocean freight remains substantial.

However, for ocean freight, shippers are seen hastening their shipments in anticipation of an expected rise in ocean freight rates.

Source: The International Air Transport Association (IATA) and the Loadstar

P.S. Easy Freight Ltd helps New Zealand importers & exporters to save money on international freight and reduce mistakes by guiding how to comply with Customs and biosecurity rules.

➔ Contact us now to learn how we can assist you.