An Update on the Global Supply Chain Situation

4-minute read

The global shipping line Maersk reports that customers continue to face a raft of challenges as the Russia-Ukraine conflict weighs on the longer-term outlook for the global economy amid concern that inflation and higher energy prices will lead to lower consumer demand, damaging international trade.

According to Maersk, the short-term outlook, however, is more positive. Cargo volumes through Shanghai are returning to pre-lockdown levels, and demand from US consumers is pulling forward the peak shipping season on North American trades.

Market Trends

The Russia-Ukraine conflict and the ensuing sanctions imposed on Moscow are adding to inflationary pressures globally and raising fears of a possible recession.

The situation is adding pressure on central banks to tighten monetary policies, including increasing interest rates.

Key to the outlook for trade is how consumers and businesses react to elevated uncertainty, higher prices, and policy changes.

In the near term, the global expansion will continue, supported by pent-up demand and the re-opening of economies.

But longer-term, substantial monetary policy tightening will increasingly weigh on economic activity with additional concerns about the outlook for China which has COVID-19-led economic consequences.

Potential scenarios depend heavily on the path of inflation and the geopolitical fallout from the war in Ukraine.

Trade Outlook

Global trade volumes declined by 2.5 per cent in May compared with a year earlier, and year-to-date growth is down by a similar level, although these come off last year’s elevated levels.

The Ukraine conflict negatively impacted container imports into Europe following the imposition of sanctions and a broader weakening in demand.

Imports into Asia were depressed due to COVID-19 lockdowns in China and a general slowdown in China’s housing market.

Imports into North America were stable at a very high level.

The outlook remains highly uncertain, reports Maersk, who sees mainly downside risks to their base scenario.

In New Zealand, the Ocean Supply Chain remains disrupted. While the market is expected to hold into August, Auckland port productivity is impacted due to labour shortage and vessel bunching. Expect vessel delays of 7-10 days.

Terminals in China are operating normally as authorities manage the COVID-19 situation. The average vessel waiting time at ports in Asia is 0-3 days.

The disruption caused by typhoons, especially in South China ports, could potentially cause a 1-2 days delay.

With ports in Europe and North America continuing to face congestion, cargo imports into Asia may also face delivery delays.

Shanghai situation

With Shanghai gradually returning to normal after the two-month city-wide lockdown in April and May, factory production is picking up.

Demand rebounded nicely in July, with positive signs of a seasonal peak on many trades.

Trucking in the city area has also been fully restored.

Intra-provincial trucking is also back to pre-lockdown levels, although truckers are subject to local testing requirements.

Maersk reports that the current situation is dynamic and subject to change.

“The situation in Shanghai is normalizing but is still both fluid and hard to predict – this combined with the strikes in Europe and the continuous congestion in the ports in North America means that our customers have a larger need for flexibility and agility than ever,” says Anne-Sophie Zerlang Karlsen, Head of Asia Pacific Ocean Customer Logistics.

Port Congestion

Terminal congestion, especially in North America and Europe, is continuing to adversely affect schedule reliability. Strikes in Germany, especially at Bremerhaven, Hamburg and Wilhelmshaven, have exacerbated the disruption caused by vessel delays.

Schedule Reliability

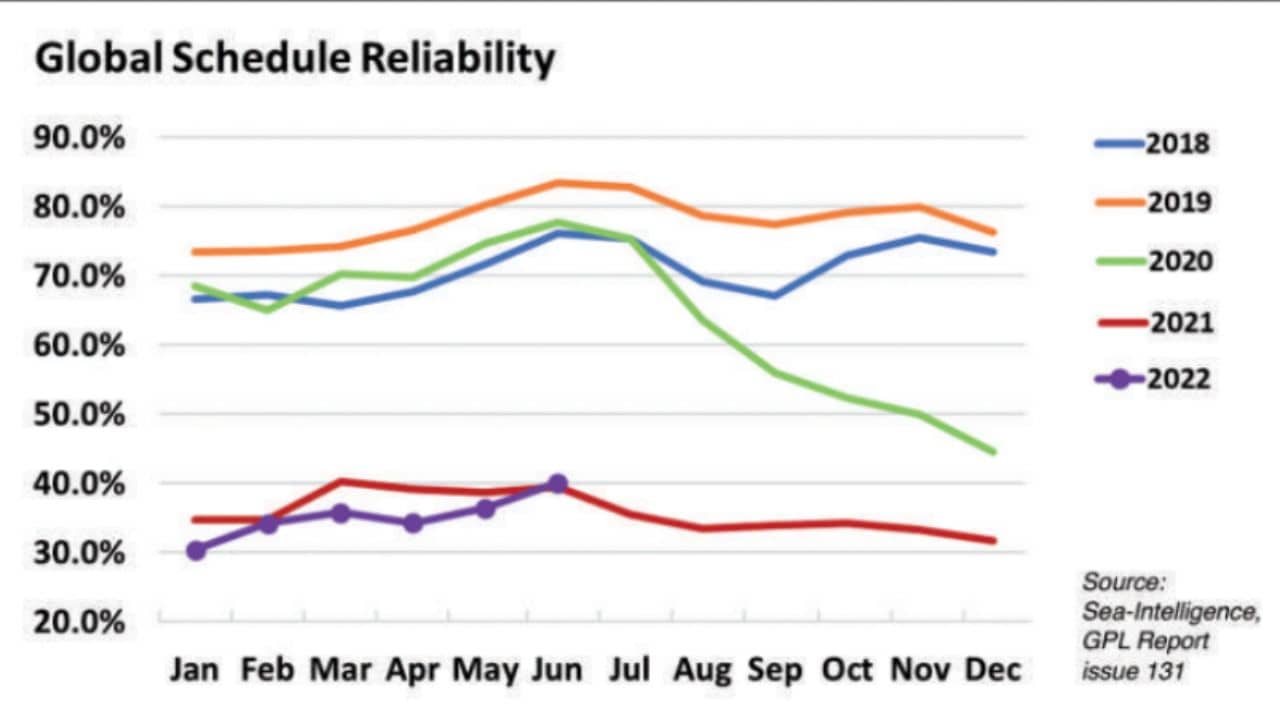

Global schedule reliability seems to have broken the trend seen since the start of this year, with schedule reliability increasing by 3.6 percentage points in June 2022 to 40.0%, according to Sea-Intelligence.

“This also marked the first time since the start of the pandemic that schedule reliability improved year-on-year,” says Alan Murphy, Sea-Intelligence CEO.

“The average delay for LATE vessel arrivals has been dropping sharply so far this year but remained unchanged M/M at 6.24 days in June.

“The delay figure is now firmly below the 7-day mark, and an improvement over the respective 2021 figure.”

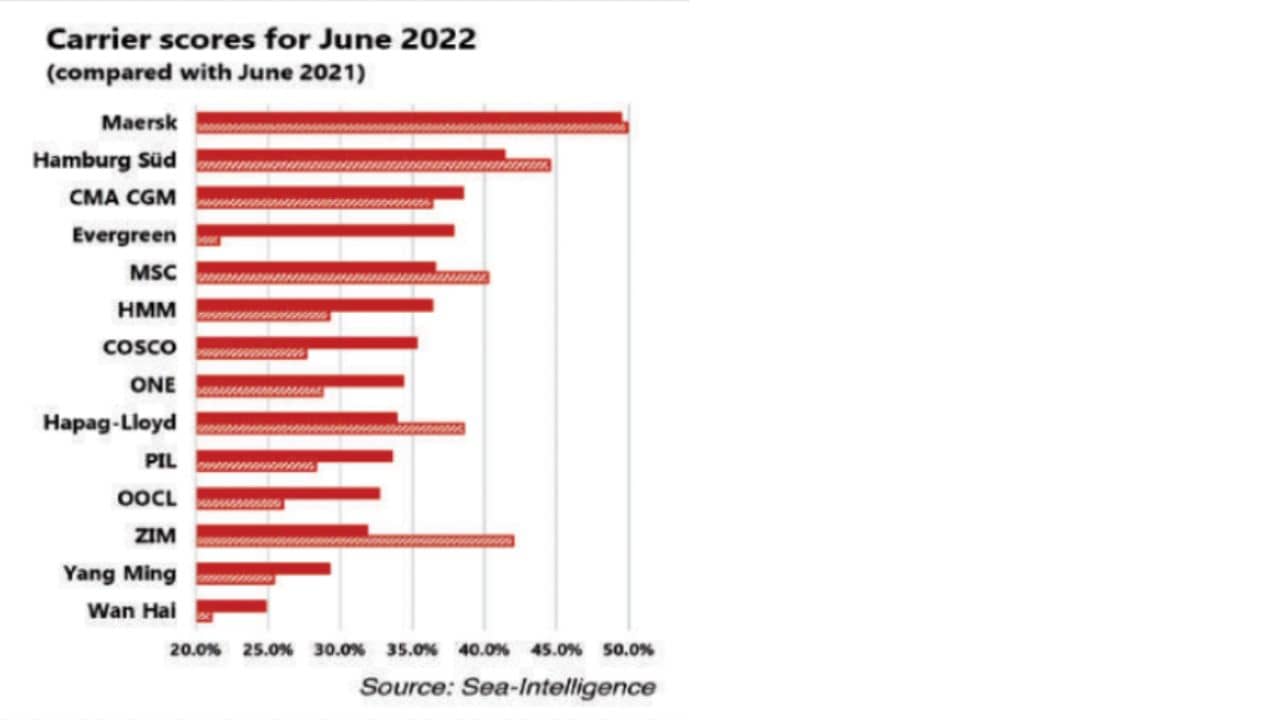

With a schedule reliability of 49.5%, Maersk was the most reliable carrier in June 2022, followed by Hamburg Süd with 41.4%. There were 10 carriers with schedule reliability of 30%-40% and only two with schedule reliability of 20%-30%.

In June 2022, once again, many of the carriers were very close to each other in schedule reliability, with 10 carriers within 7 percentage points of each other. Wan Hai had the lowest schedule reliability in June 2022 of 24.8%.

On a Y/Y level, nine of the top-14 carriers recorded an improvement in schedule reliability in June 2022, with Evergreen recording the only double-digit improvement of 16.2 percentage points.

Air Freight Update

Greater China volumes have fallen in July due to the impact of the summer holidays.

There is minimal impact on airfreight from sporadic COVID-19 outbreaks in China.

Carriers have cancelled several flights to Europe and North America due to lower cargo demand.

Air cargo freight rates have also fallen, making air cargo more attractive to customers.

In Hong Kong, capacity has increased as airlines reintroduced more flights after the government eased COVID-19 restrictions.

As China slowly returns to pre-lockdown operational levels, extra airline capacity has led freight rates to fall across all origin airports into Australia and New Zealand

There is still a cargo backlog in Shanghai, which is lengthening the transit times between international airports.

The Trans-Tasman markets remain challenging for consumers as airlines continue to hold off releasing new capacity.

Source: Maersk Market Update and The New Zealand Shipping Gazette

P.S. Easy Freight Ltd helps New Zealand importers & exporters to save money on international freight and reduce mistakes by guiding how to comply with Customs and biosecurity rules.

➔ Contact us now to learn how we can assist you.