Strong Start to 2024: Airfreight Thrives Amid Shipping Delays

2-minute read

Amidst disruptions in the Red Sea, the reliability of ocean shipping schedules took a significant hit in January, dropping to just 39.4%, marking the lowest point since October 2022, according to a report by Sea Intelligence cited by the Loadstar.

Consequently, shippers are increasingly turning to sea-air or airfreight alternatives to navigate the challenges posed by the crisis.

The International Air Transport Association (IATA) released data for January 2024 global air cargo markets, indicating a strong start to 2024.

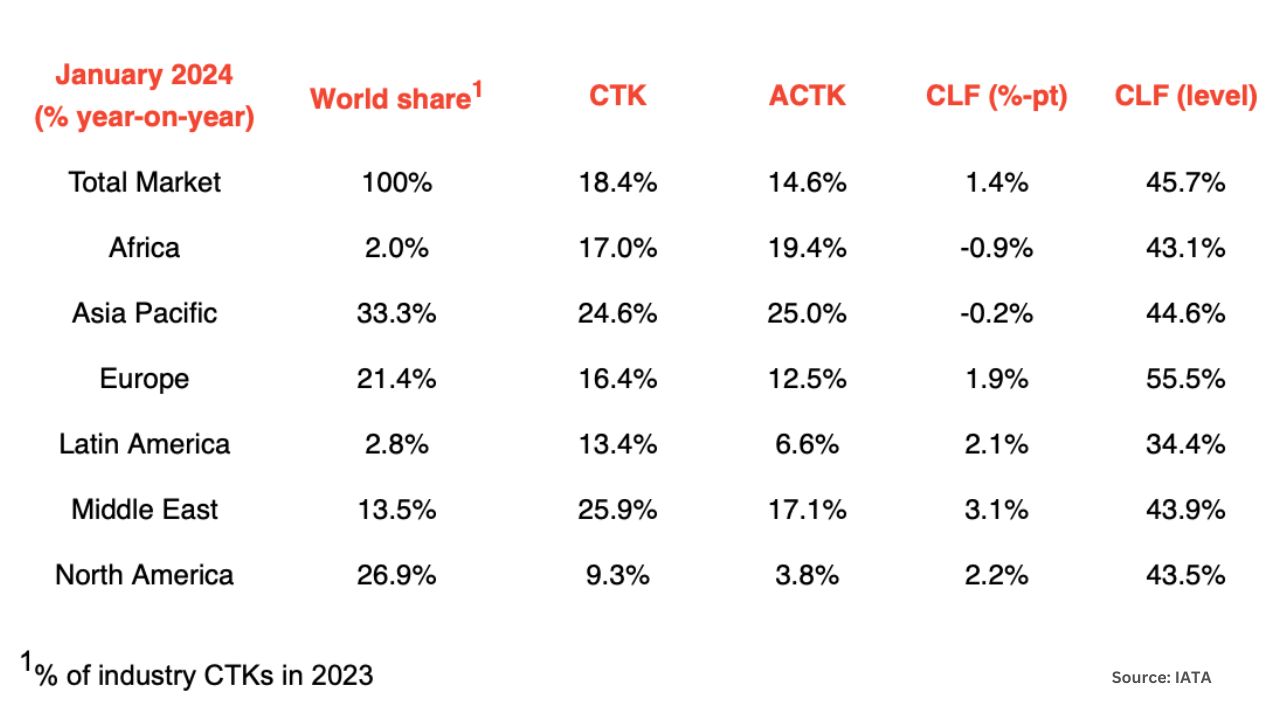

• Total demand, measured in cargo tonne-kilometers (CTKs*), increased by 18.4% compared to January 2023 levels (19.8% for international operations). This significant upturn marks the highest annual growth in cargo tonne-kilometers (CTKs) since the summer season of 2021.

• Capacity, measured in available cargo tonne-kilometres (ACTKs), was up 14.6% compared to January 2023 (18.2% for international operations). This was largely related to the growth in belly capacity. International belly capacity rose 25.8% year-on-year (YoY) on the strength of passenger markets.

“Air cargo demand was up 18.4% year-on-year in January. This is a strong start to the year. In particular, the booming e-commerce sector is continuing to help air cargo demand to trend above growth in both trade and production since the last quarter of 2023. The counterweight to this good news is uncertainty over how China’s economic slowdown will unfold. This will be on the minds of air cargo executives meeting in Hong Kong next week for the IATA World Cargo Symposium with an agenda focused on digitalization, efficiency and sustainability,” said Willie Walsh, IATA’s Director General.

Air cargo growth outpaced trade and production. Several factors in the operating environment should be noted:

• Global cross-border trade increased by 1.0% in December compared to the previous month (-0.2% YoY).

According to IATA, this increase is likely the result of multiple factors pulling in opposite directions. Capacity constraints in maritime shipping imposed by the attacks in the Red Sea weighed down on increased demand triggered by the Holiday season and various types of business year-end transactions.

• In January, the manufacturing output Purchasing Managers’ Index (PMI) improved to 50.3, surpassing the 50 mark for the first time in eight months, indicating expansion.

The new export orders PMI also saw an increase to 48.8, but remains below the critical 50 threshold, suggesting a continuing yet decelerating decline in global exports.

• Inflation in major economies continued to ease from its peak in terms of Consumer Price Index (CPI) in January, reaching 3.1% in both the US and in the EU, and 2.1% in Japan.

China’s CPI, however, indicated deflation for the fourth consecutive month, raising concerns of an economic slowdown. China’s negative inflation rate of -0.8% was the lowest since the Global Financial Crisis in 2009.

Asia-Pacific Regional Performance

Asia-Pacific airlines saw their air cargo volumes increase by 24.6% in January 2024 compared to the same month in 2023.

This performance was above the previous month (+18.5%). Carriers in the region benefited from ongoing growth in international CTKs on three major trade lanes: Africa-Asia (+52.5%), Middle East-Asia (+29.5%) and Europe-Asia (+27.5%).

Available capacity for the region’s airlines increased by 25.0% compared to January 2023 as more belly capacity came online from the passenger side of the business.

Source: The International Air Transport Association (IATA) Air Cargo Market Analysis January 2024 and the Loadstar

P.S. Easy Freight Ltd helps New Zealand importers & exporters to save money on international freight and reduce mistakes by guiding how to comply with Customs and biosecurity rules.

➔ Contact us now to learn how we can assist you.