Your Shipping Costs Rise Again: What You Need to Know

5-minute read

The cost of shipping goods has once again surged, posing challenges for businesses and consumers worldwide.

As customs brokers, we stay informed about market developments, ensuring our clients are well-prepared for these changes.

In this article, we look at the latest report from the New Zealand Ministry of Foreign Affairs and Trade’s Economic Division (MFAT), which reveals that shipping rates have nearly doubled since late April and the reasons behind it.

These rising costs are due to disruptions in key shipping routes, especially the Red Sea, where security issues have diverted traffic from the Suez Canal.

This detour, along with a shortage of shipping containers and congestion at major ports, have reshaped global logistics and impacted economies from Asia to Europe.

As these trends unfold, concerns about inflation and economic stability are growing, echoing the challenges during the COVID-19 pandemic.

However, there are signs that this current rise in costs, while significant, may not be as severe as what was experienced in previous years, concludes the report by MFAT.

Disruptions in the Red Sea Continue to Weigh on Global Shipping

Since December last year, commercial shipping between Asia and Europe has faced significant disruption in the Red Sea because of Houthi attacks on vessels transiting the area.

For the most part, commercial shipping companies decided to divert shipping away from the most direct route, via the Suez Canal, and instead sail around the African continent.

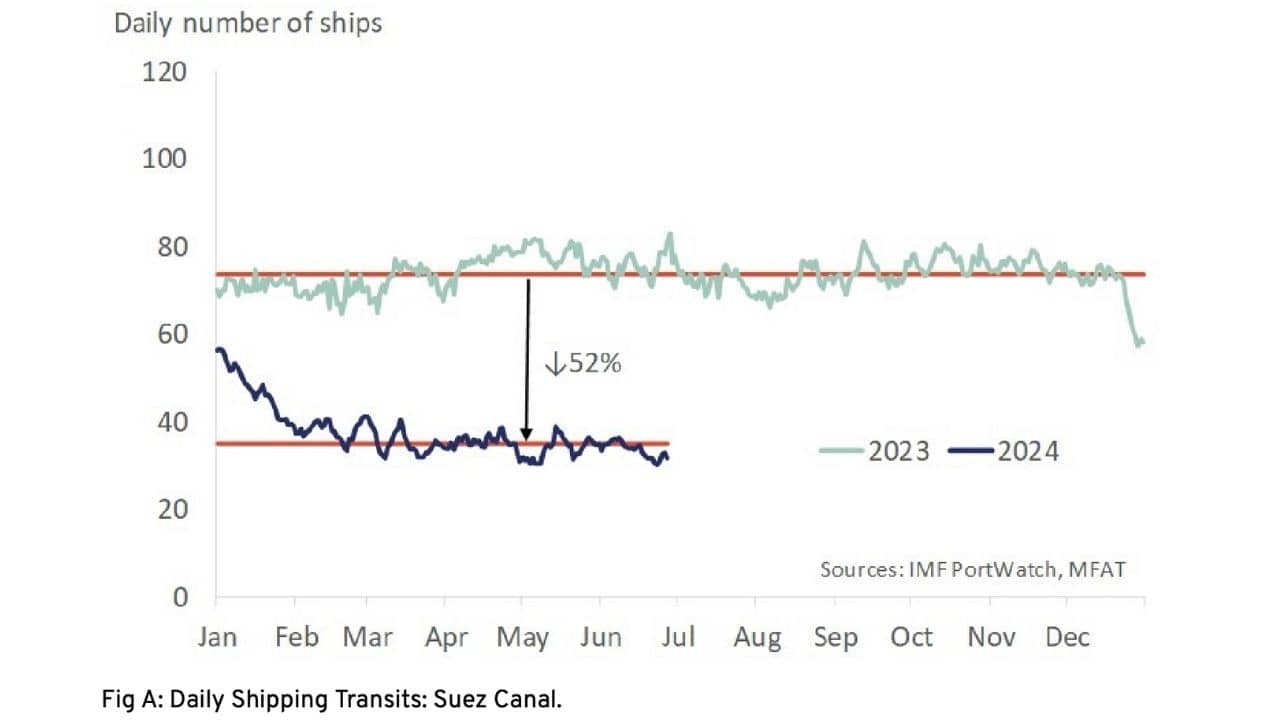

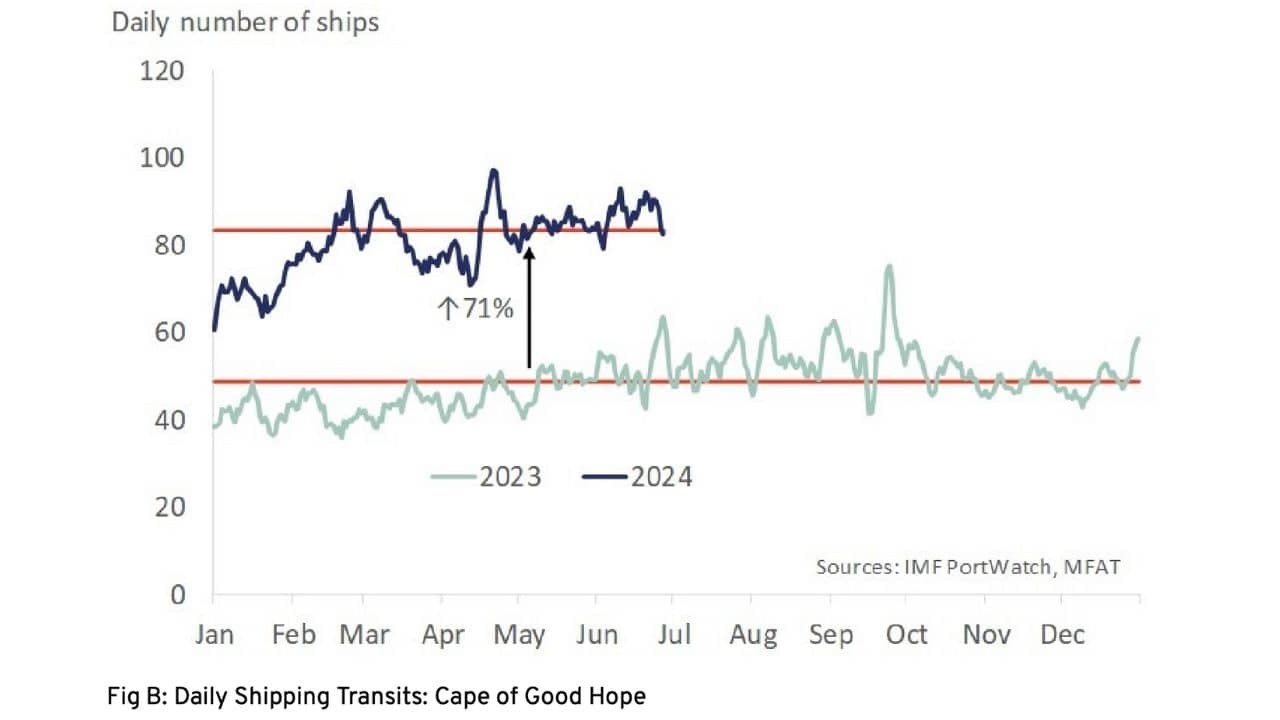

Data from IMF’s PortWatch reveals that since December last year, sailings of commercial shipping via the Suez Canal fell by around 40 per day or 52% (Figure 1A).

Figure 1: Commercial shipping continues to avoid the Red Sea

At the same time, daily sailings around the Cape of Good Hope gained an average of 35 sailings or 71% (Figure 1B).

The move added around 40% in voyage distance, causing shipping delays of 2-5 weeks and raising trade costs to and from Europe.

Further adding to global shipping woes, the Panama Canal, another key trade route between the Indo-Pacific and Europe, also added to the disruption of global sea trade.

Low water levels caused by an extended period of drought last year forced operators to place restrictions on the number of ships transiting the waterway and draft limits that reduced the weight these ships can carry.

Shipping Costs Higher Once Again

After an initial jump in freight rates in January, shipping costs began to moderate as global supply chains adjusted to a new reality.

Since May, however, we have seen the resumption of rising freight costs.

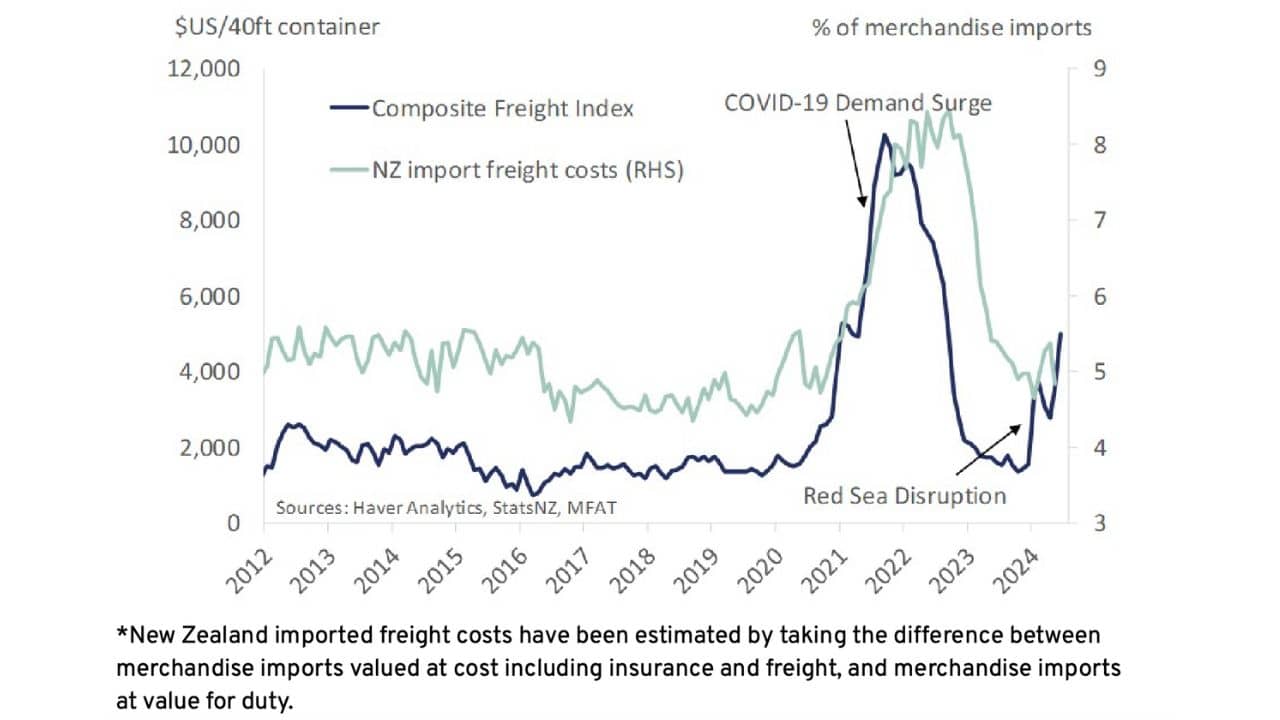

Global measures of shipping rates have almost doubled since late April (see Figure 2 below).

And on some routes, such as Shanghai to Rotterdam, costs have experienced much larger gains.

Fortunately, overall shipping costs still sit well below the peak experienced during COVID-19.

However, it will take time to show up in New Zealand’s economic data, with shipping costs typically being recorded with a lag of around 3-to-9-months (Figure 2).

Figure 2: Rising shipping costs take time to be felt in New Zealand*

Global Sea Freight Capacity

Current shipping disruptions have led global shipping capacity to become finely balanced, meaning prices are more sensitive to changes in demand.

The available shipping capacity has been taken up because longer sailing times between Asia and Europe mean more ships are needed to service these routes.

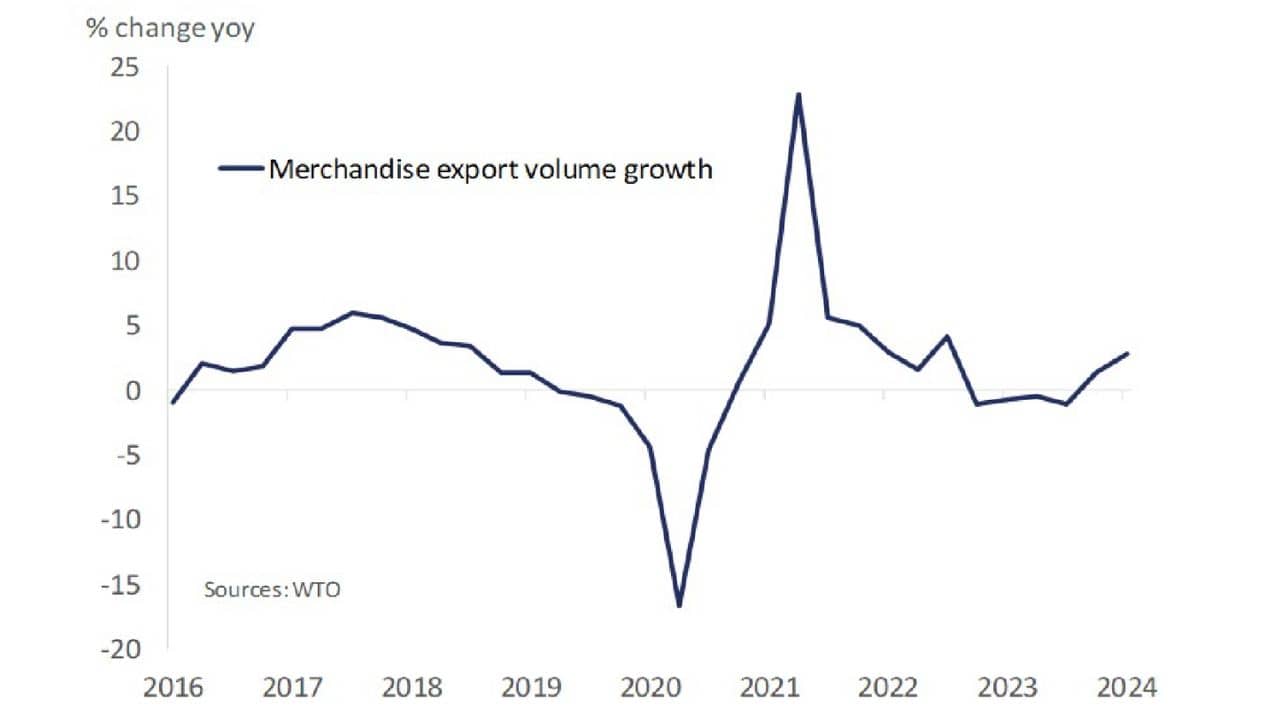

At the same time, global merchandise export volumes are recovering (Figure 3), particularly those from Asia.

Figure 3: Global export growth is recovering after a subdued 2023

For example, China’s goods exports have shown strong growth over the first half of 2024 and even posting a 7.6% yoy jump in May.

A resilient US economy has supported demand, but there has also been a general rebuilding of inventories globally.

Global trade is expected to recover further over 2024, with the WTO forecasting the volume of global merchandise exports will expand 2.6% this year, following a small contraction last year.

Shortage of Shipping Containers

Another consequence of ongoing disruption has been a shortage of shipping containers.

With ships spending more time in transit, the global shipping sector requires more equipment to transport goods to and from Europe.

Moreover, the net flow of containers tends to be from China, a major global manufacturer, to consumers in the West.

Currently, empty containers aren’t returning to where they are needed quickly enough, adding to the equipment shortages.

In addition, new container production dropped off sharply last year as merchandise trade experienced a post-COVID fall.

The shortage has seen the price of containers rise sharply, with containers in China doubling in price compared to September.

The rerouting of ships around Africa and equipment shortages are causing flow-on effects, including an increase in off-schedule arrivals that is playing havoc with logistics management and increasing congestion at some major Asian ports.

Ships calling on key Asian ports, such as Singapore and Shanghai, are experiencing delays in entering ports and in the loading and unloading of cargo.

Encouraging Outlook

While shipping costs will likely remain elevated while commercial shipping avoids the Red Sea, current supply-chain issues are not expected to match those experienced during the pandemic disruption, the MFAT report concludes.

Firstly, the rise in shipping costs this year has not been experienced universally and has been most acute on routes between Asia and Europe.

In contrast, the COVID-19-driven surge in shipping costs was felt worldwide, resulting from an explosion in the demand for goods in 2021.

Secondly, manufacturers are already responding to the shortage of containers by boosting production.

China is the largest manufacturer of shipping containers, and production has been ramping up. According to Bloomberg(external link), over the first five months of this year, manufacturers in China have produced a similar number of new containers as they did over the same period in 2021.

As the new supply of containers comes online, they should help to plug some of the gaps experienced by shipping companies.

Thirdly, conditions in the Panama Canal are improving and allowing authorities to begin easing restrictions there.

Water levels in Lake Gatun, the main body of water that feeds the canal system, have steadily risen since April.

And above-average rainfall forecasts have allowed canal authorities to increase the number of ships able to ply the waterway.

From late July, 34 ships per day will be able to traverse the canal, up from 24 at the start of 2024 and not far from 36-38 ships per day, typically under normal conditions.

Authorities have also relaxed vessel draft limits, allowing ships to carry larger loads through the waterway.

Although the Panama Canal is a far smaller chokepoint than the Suez Canal, accounting for around 7% of global sea trade, improved conditions should take some pressure off global shipping.

Finally, the economic climate, both here in New Zealand and abroad, vastly differs from what was experienced during the pandemic.

For instance, the sustained rise in inflation during the COVID-19 pandemic was driven by a global surge in broad-based demand across goods, labour, and capital markets.

In contrast, current global shipping disruption is an isolated supply-side inflation factor.

At the same time, demand is far more subdued, with households tightening their belts in the face of high interest rates and rising unemployment.

And while rising shipping costs remain a risk factor in the fight against inflation, the current episode is likely to be less severe than the experience during COVID-19.

Source: New Zealand Foreign Affairs & Trade. Global shipping costs are rising once again. Market Intelligence Report. July 2024

P.S. Easy Freight Ltd helps New Zealand importers & exporters to save money on international freight and reduce mistakes by guiding how to comply with Customs and biosecurity rules.

➔ Contact us now to learn how we can assist you.