How Retailers Will Operate After COVID-19 (New Behaviours)

6-minute read

The coronavirus (COVID-19) crisis is forcing stores to close across the globe. How should traditional retailers change in this new environment and with new consumer expectations and behavior?

The allure of brick-and-mortar stores includes lively display windows, helpful staff and plenty of goods on shelves.

But there are downsides: limited opening hours, seasonal inventory and the distinct possibility of not finding what you want.

The inescapable reality of a global pandemic is also forcing a radical rethink of the rules of retail in 2020. It’s a challenge – but for many, it can be a great opportunity.

In the international, internet-driven marketplace, where a vast variety of merchandise is only a click away, iconic stores – from Sears to Barneys in the U.S., Marks & Spencer in the U.K. and Galeria Karstadt Kaufhof in Germany – have been hard hit.

Even before the COVID-19 crisis, permanent store closures and bankruptcies seemed to be announced almost every day. In the U.S., a record 9,300 retail locations shut up shop for good in 2019, and 2020 will see more.

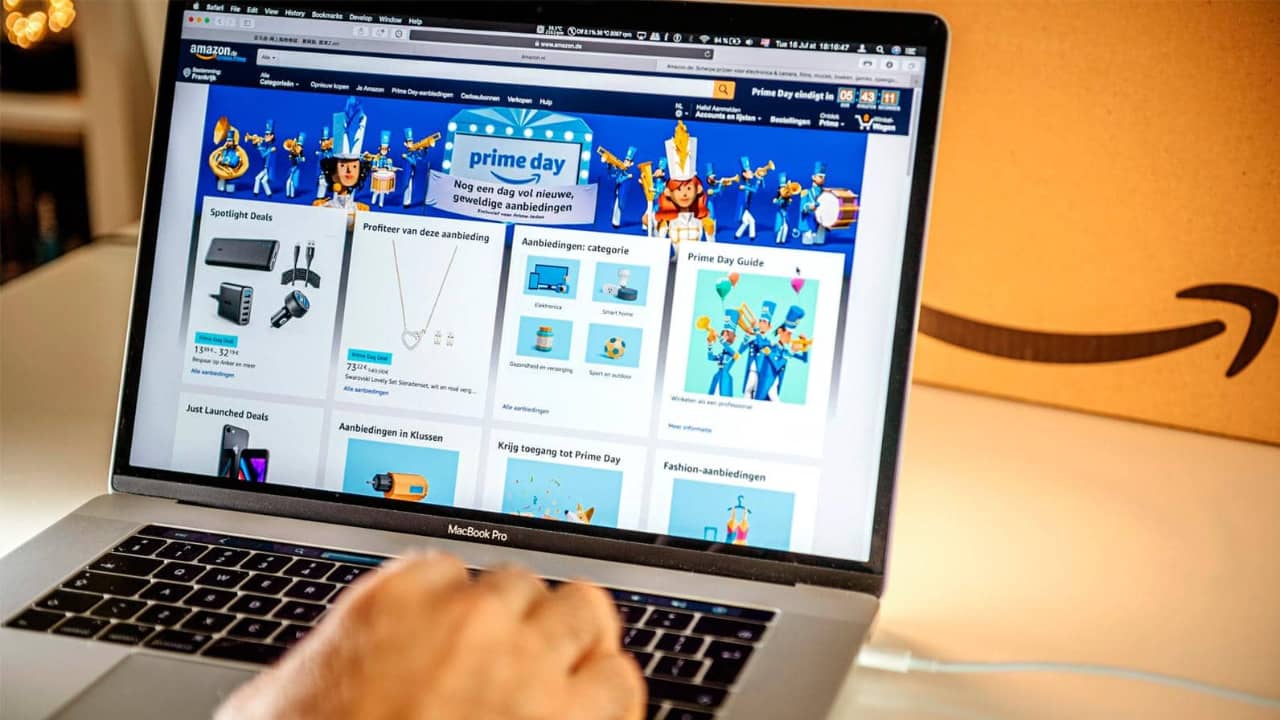

At the same time, online merchants marked their own milestones, achieving unparalleled sales on Black Friday, Cyber Monday, Prime Day and more in 2019.

More recently, coronavirus-related health restrictions in some areas requiring temporary store closures meant that, for a while anyway, online became the only game in town.

Experienced e-tailers scrambled to meet demand, while omnichannel companies shifted resources to serve their online businesses – and the ones who didn’t have a strong online channel got worried.

The outcome has been what McKinsey calls a “seismic shift in digital engagement.”

In an April 2020 report, the firm said physical distancing rules in many markets had resulted in higher consumption of online media and significantly accelerated e-commerce.

New audiences – many rural or older – were introduced by necessity to e-shopping, delivery and click-and-collect for items such as groceries. McKinsey predicts these novel habits may well outlast a return to customary trading.

In the U.S., App Annie reported that grocery app downloads had reached record highs. Walmart Grocery downloads, for example, increased by more than 460% in April as compared with January.

Other delivery apps, such as Instacart and Shipt, have seen their daily downloads surge by 218% and 124% respectively. The big winner of the COVID-19 situation is online grocery, which will see its penetration expand.

In the report “The Impact of COVID-19 on Online Grocery,” Fabric states: “The online share of grocery sales will approach and could even exceed 10% this year, four years sooner than previously forecasted.”

“A company’s locality and history matter less now than before,” says Brian Lee, Senior Principal, Research at business research and advisory company Gartner L2.

“What’s most important to the consumer is convenience, price and service.”

Yet the blame for what some have dubbed the “retail apocalypse” does not lie solely at the feet of e-commerce, and the pandemic has only pushed it into fast forward.

As economist Austan Goolsbee writes in The New York Times, “The broad forces hitting retail are more a lesson in economics than in the power of disruptive technology.”

This consumer culture evolution is part tech-driven, part generational – aspects that are intricately connected. Now it’s being accelerated by the COVID-19 crisis at an unprecedented pace.

Stores haven’t changed much in the past couple of decades, but their customers have. Through various factors, the act of shopping is being redefined.

Shoppers who can’t remember a world without the internet are driving trends.

Influencers and virtual friends trade in Instagram posts, Facebook marketplaces, TikTok, Depop stores or YouTube channels.

We are seeing strong momentum in social commerce, and emerging TV channels, such as NBCUniversal, entering shoppable TV.

These consumers want socially aware companies that speak their language and value charitable giving, activism and more thoughtful, sustainable consumerism.

Second Time Around

In a recent report on sustainability in the U.K., research firm GlobalData found that more than 90% of consumers believe retailers should be acting sustainably – and almost 80% think that retailers are not doing enough to address issues around sustainability and climate change.

“More sustainable and ethical options are growing in popularity, including dedicated retailers, slow fashion and resale apps,” suggests GlobalData analyst Emily Salter.

“Clothing retailers could capitalize on this trend by launching rental services, as well as online second-hand marketplaces.”

The clothing rental business could reach $2.5 billion by 2023 in the U.S. alone, says GlobalData.

Startups like ThredUP and Rent the Runway led the charge, but some traditional retailers are muscling in.

Lifestyle chain Urban Outfitters and its affiliates participate in the monthly Nuuly clothing subscription service.

Even department store Nordstrom has launched a second-hand business, See You Tomorrow, stocked with returned items.

The online resale business is also exploding. Companies such as Rebag, RealReal, Backmarket and Vestiaire Collective are riding the wave of consumer concerns around sustainability – and with the crisis ongoing, we can expect to see more conscientious buyers when it comes to spending.

By the end of April, Vestiaire Collective had raised $64.2 million to grow its luxury resale marketplace in response to investor interest in “Good for the planet, good for the wallet” models.

According to the 2019 study “True-Luxury Global Consumer Insight” by Boston Consulting Group (BCG) and Altagamma, luxury resale is a booming market, expected to grow by 12% each year to reach $36 billion by 2021.

And while the 2020 pandemic hit all sectors of retail, some resellers saw an influx of new wares from lockdown spring cleaning.

Rental and resale moderate price points appeal to those newly on a budget, and businesses already have in-house cleaning systems.

Retail locations of rental services, however, were hit hard; Rent the Runway closed all its brick-and-mortar shops in four U.S. cities in March.

From Venture to Adventure

Where digital and heritage brands alike can excel is in the realm of experience.

It’s likely that, as commerce gradually emerges from months of global lockdowns and restrictions, customers will be sated with the virtual and hungry for the tangible.

At the same time, retail locations must manage crowd sizes as well as expectations; buyers may be eager but cautious.

Who tops the experience game? “Nike is probably leading the way regarding brands that are really pushing that experimental, consumer journey, combined with a mix of digital and physical experiences,” says Patrick Kelleher, Global Chief Development Officer, DHL Supply Chain.

In its New York and Miami flagship stores, the Nike+ Trial Zones have been giving customers the chance to put Nike shoes to the test – kicking balls with soccer cleats or wearing basketball shoes on in-store courts.

On the luxury side, London-based Matchesfashion has been reimagining retail with a boutique that’s a hotspot for culture and commerce – broadcasting exclusive in-store experiences via podcasts and streamed videos, and offering specialized virtual services with apps and social shopping.

And shoppers visiting The Journey – the Toronto concept store from outerwear brand Canada Goose – can walk through video and audio installations of Arctic conditions, including actual snow and – for really cool customers – a room lowered to -12 °C.

The next generation of experiential shopping, however, will be digital-first.

The pandemic has shown that companies need new ways to connect to consumers. They will have to make creative choices in the face of the digital reality that is here to stay.

Reinventing Stores

It could be the end of stores as we know them, Kelleher believes.

“Large stores may become warehouses; the small stores may have zero inventory, stores could be a showroom, a delivery warehouse, a restaurant, and a pop-up market all in one,” he predicts, envisioning a breakdown of retail locations into a practical mix of showrooms and storerooms.

In recent weeks we have seen announcements from U.S. supermarkets Whole Foods Market, Hy Vee and Kroger, as well as fashion designer Kendra Scott’s chain, about reconverting retail locations into fulfillment centers.

U.S. bakery Panera Bread converted its bakery-café business to sell groceries, and H-E-B is selling prepared meals from its restaurant. We are moving from omni channel to omni supply.

For retail, adapt or die may be the motto of the coming year, and it’s a slogan that’s been put to a sharp shock of a test in 2020.

Agile companies who have adapted, learned and thrived during these challenging months will be ahead of the game for years to come.

Rather than investing in untested new market incursions that may deplete capital, companies can sell directly to consumers online and deliver from regional warehouses – bypassing distributors, real estate and property taxes.

“It’s about a mindset change,” says Kelleher, “and recognizing the importance of this growing sales channel and this new way of reaching consumers at the top level.

The ongoing impact of COVID-19 has shown that the online channel is even more significant than we already thought and that it’s here to stay.” — Susanne Stein and Nabil Malouli

P.S. Easy Freight Ltd helps New Zealand importers & exporters to save money on international freight and reduce mistakes by guiding how to comply with Customs and biosecurity rules.

➔ Contact us now to learn how we can assist you.