NZ Ocean Freight Rates Go Up as Container Shipping Recovers

3-minute read

Demand for container shipping services is starting to rebound as coronavirus lockdowns are eased, although the recovery is uneven and fresh outbreaks remain an ongoing risk.

Space availability on services to northern Europe is tightening, while the scramble for space on the trans-Pacific trade is becoming dramatic.

For the first time since 2010 and despite year-on-year declines in revenues and tonnages, the top ten container carriers racked up operating profits per twenty-foot equivalent unit (TEU) transported in the second quarter.

Falling bunker/fuel prices helped, as lines benefited from lags in adjustments to Bunker Adjustment Factor (BAF) indexes during that period. This enabled them to benefit from lower prices even while charging customers BAFs based on the higher prices before adjustment.

As the cost of oil plummeted, the prices of IMO 2020-compliant very low-sulfur fuel oil (VLSFO) and standard bunker fuel have also converged. Under pressure from dissatisfied customers, a number of leading carriers eventually scrapped low sulfur surcharges (LSS) in early September.

Although lower operating costs have helped container lines during the pandemic, their refusal to embark on a price war has bolstered bottom lines most.

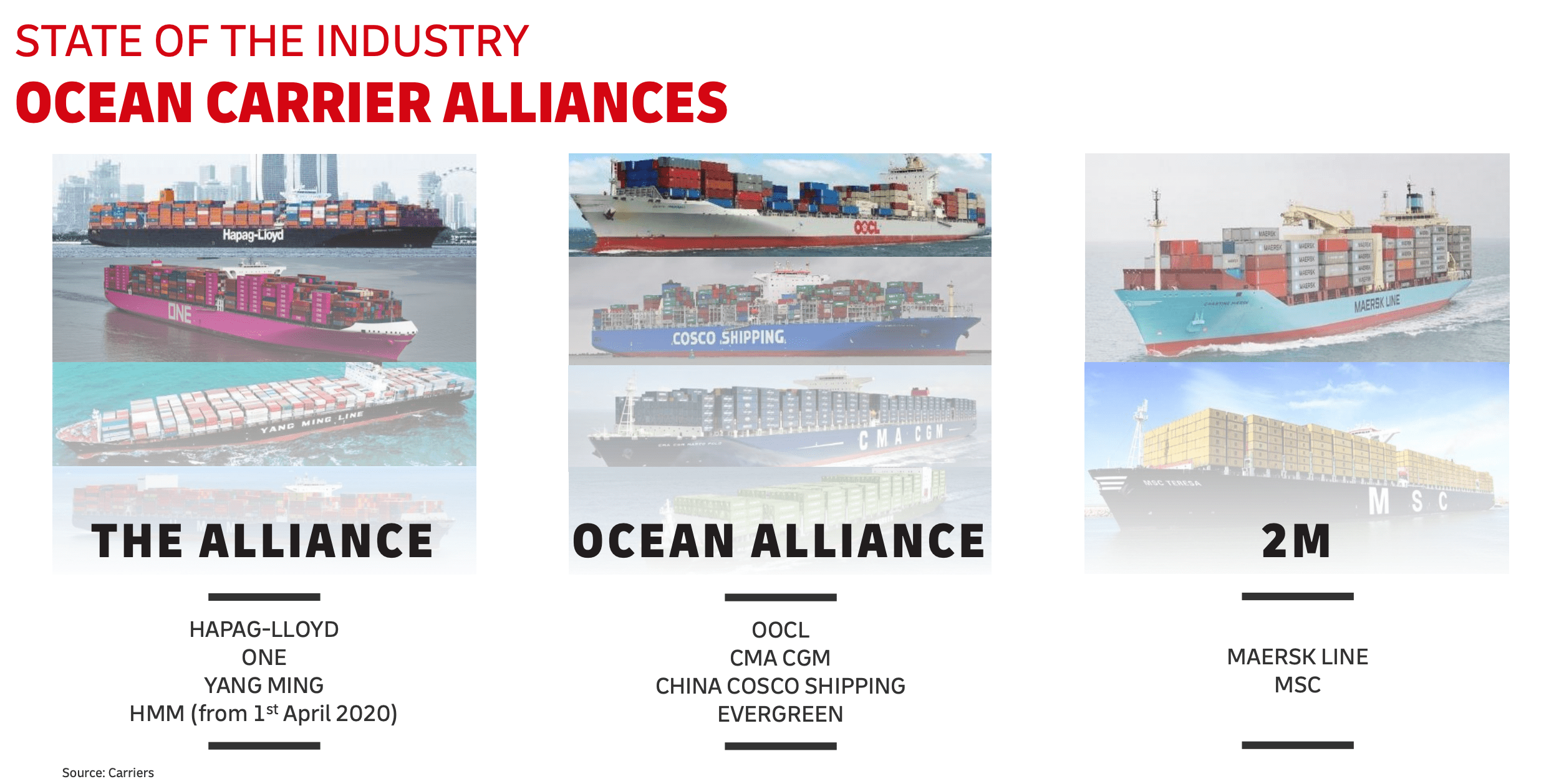

Instead, aided by the alliance system and consolidation of recent years, carriers collectively withdrew huge amounts of capacity via void sailings and lay-ups, prompting freight rates on the major East-West trades to retain their buoyancy before climbing.

Meanwhile, freight rates continue to strengthen. Despite lower year-on-year demand and historically depressed fuel prices, container shipping lines have maintained strict capacity discipline and a firm grip on pricing.

The upshot is a market in which liner shipping service levels and schedule reliability for customers are in decline even as freight costs rise.

Illustrating the point, shipping analyst firm Sea-Intelligence’s latest survey of liner schedule reliability found that only 37% of deep-sea services offered over 85 percent schedule reliability.

The firm noted that this result is not far from the lowest level recorded since it started measuring reliability in 2012.

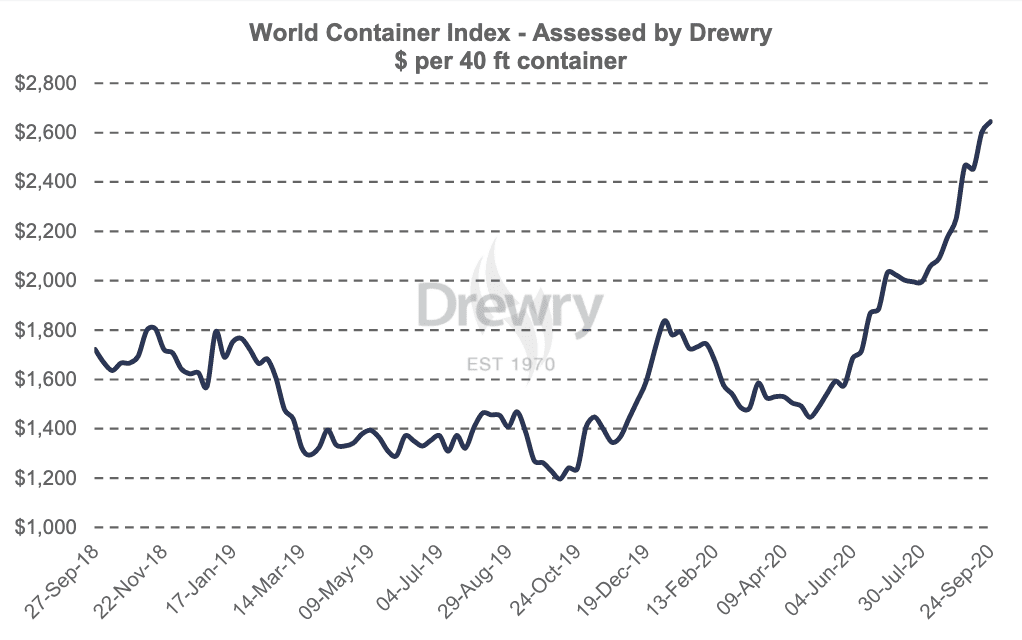

Meanwhile, maritime research consultancy Drewry’s assessment of the World Container Index (WCI) on 24 September noted an 1.6% week-on-week increase in the composite index, taking it to 108% higher than a year earlier.

Drewry’s composite World Container index increased by 1.6% to $2,644 per 40ft container and reached an 8-year high.

Container freight rates are surging to new 2020 highs driven by high demand and equipment shortages in Asian ports.

Maritime analyst firm Maritime Strategies International (MSI) believes that, on nearly all trade lanes, the container industry appears to be “past the worst,” at least in terms of demand.

It could find “little evidence that liner companies are deviating from a course of swiftly and aggressively removing capacity where this is deemed appropriate”.

Most carriers have been managing capacity closely and this has kept rates surprisingly strong and stable.

Shippers may have to contend with these higher rates unless one carrier breaks rank, which could cause prices to collapse. But that seems unlikely in the current climate.

The result could be a new normal of relatively high freight rates immune from the sharp pricing crashes that have been common for container shipping, according to MSI container market analyst Daniel Richards.

“We see little reason to expect a notable decrease in freight rates in the near-term,” he said.

“Market share-grabbing strategies by individual lines do remain a source of risk, but the evidence of the crisis so far suggests under-cutting activity is not an attractive strategy for the major liner companies,” added Richards.

How demand recovers as global economies stagger back to life will be critical and the damage suffered by ocean shipping stakeholders already should not be underestimated.

Analysis by Seabury Consulting showed that containerized trade grew only modestly by 1.7 % in 2019 even before the Covid-19 crisis.

Containerized trade is expected to decline by 14% this year, which is the largest year-on-year decline on record.

Almost all container trade lanes are forecast to see double-digit volume contractions in 2020, according to the consultancy.

Perishables is the only industry not predicted to suffer a volume decline in 2020.

The capital equipment and automotive verticals are forecast to show the strongest contractions at 18% and 25%, respectively.

The bounce-back is not expected to be dramatic. In 2021, we will start to see a recovery toward pre-Covid-19 volumes.

Container trade will almost be back at 2019 levels in 2022, and is estimated to grow by approximately 3% after that.

P.S. Easy Freight Ltd helps New Zealand importers & exporters to save money on international freight and reduce mistakes by guiding how to comply with Customs and biosecurity rules.

➔ Contact us now to learn how we can assist you.