Key Global Business Risks and Growing Cyber Threats in 2024

4-minute read

The evolving landscape of global business risks is front and centre in the Allianz Risk Barometer 2024, which sheds light on the most pressing challenges faced by companies worldwide.

According to the Allianz recent survey on business risks, the main problems companies are facing worldwide right now are digitalization, climate change, and uncertain global politics.

Many of these issues are causing real problems, like extreme weather, cyber attacks, and conflicts between regions. These challenges are expected to put a strain on the ability of companies to adapt and survive.

Last year, we examined the significant business risks for 2023 using the Allianz Risk Barometer. Now, let’s explore how this year’s findings compare to those from the previous year.

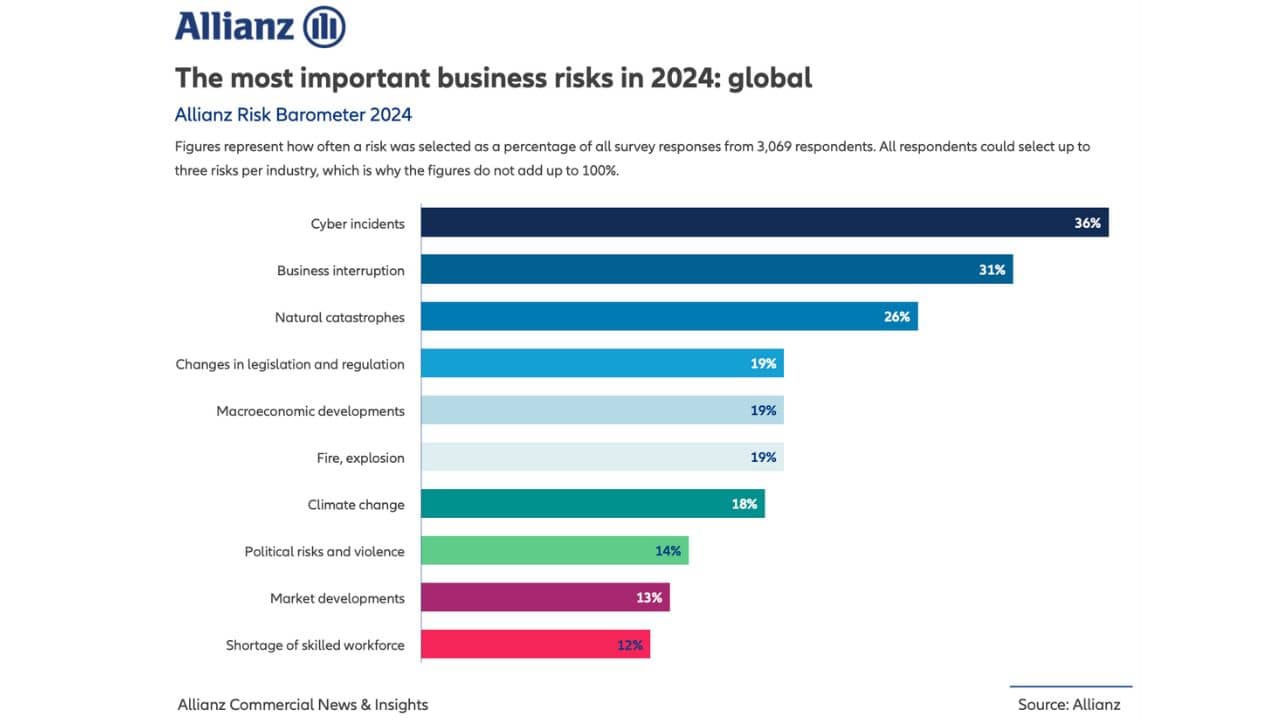

According to the Allianz Risk Barometer 2024, a cyber event claims the top spot as the leading global business risk for 2024.

The survey reveals that concerns about cyber incidents, including ransomware attacks, data breaches, and IT disruptions, rank highest among global business worries this year.

Business interruption closely follows as the second most significant peril.

The latest compilation of top global business risks, based on insights from over 3,000 risk management professionals, identifies natural catastrophes, fire, explosion, political risks and violence as notable risers in the rankings.

Allianz Commercial CEO Petros Papanikolaou comments on the findings, stating,

“The top risks and major risers in this year’s Allianz Risk Barometer reflect the big issues facing companies around the world right now – digitalization, climate change, and an uncertain geopolitical environment.”

Papanikolaou emphasizes the impact of these risks, noting that extreme weather, ransomware attacks, and regional conflicts are expected to test the resilience of supply chains and business models in 2024. He urges brokers and insurance customers to adjust their insurance covers accordingly.

The survey highlights that large corporations, mid-size companies, and smaller businesses share common concerns, with cyber threats, business interruption, and natural catastrophes topping their risk lists.

However, a growing resilience gap between large and smaller companies is noted, as larger organizations have heightened risk awareness since the pandemic, actively upgrading their resilience.

Conversely, smaller businesses face challenges in allocating time and resources to identify and prepare for various risk scenarios, resulting in longer recovery times after unexpected incidents.

In terms of cyber activity trends for 2024, the Allianz Risk Barometer indicates that cyber incidents (36% of overall responses) remain the most critical global risk for the third consecutive year.

Cybercriminals are increasingly leveraging new technologies, such as generative artificial intelligence, to automate and accelerate attacks.

Data breaches are identified as the most concerning cyber threat, followed by attacks on critical infrastructure and physical assets. The report notes a significant increase in ransomware attacks in 2023, with insurance claims activity rising by over 50% compared to 2022.

“Cyber criminals are exploring ways to use new technologies such as generative artificial intelligence (AI) to automate and accelerate attacks, creating more effective malware and phishing. The growing number of incidents caused by poor cyber security, in mobile devices in particular, a shortage of millions of cyber security professionals, and the threat facing smaller companies because of their reliance on IT outsourcing are also expected to drive cyber activity in 2024,“ explains Scott Sayce, Global Head of Cyber, Allianz Commercial.

According to the Loadstar, crime in the digital sphere of supply chains and cybercrime itself are rising concerns.

Big players like DP World, DNV and Expeditors all faced large-scale cyber-attacks last year.

The TT Club logistics risk manager Joshua Finch told the Loadstar: “What we’ve seen a lot is where a criminal organisation will impersonate a legitimate carrier. They will hack into a haulage firm or carrier’s business and copy documents to convincingly impersonate that firm.”

The TT Club’s MD of loss prevention, Mike Yarwood, explained to the Loadstar: “The fact that so many records are now electronic and on a server somewhere means they are accessible to someone who knows how to get at them, something we consider generally as ‘internet-enabled crime’.”

Business interruption (31%), despite a slight easing of post-pandemic supply chain disruptions in 2023, retains its position as the second biggest threat in 2024.

The survey emphasizes the interconnectedness of the global business environment and the reliance on supply chains for critical products or services.

Natural catastrophes (26%), ranking third, experienced a notable rise, moving up three positions.

The survey highlights 2023 as a record-breaking year for natural catastrophes, with extreme weather events causing insured losses exceeding US$100 billion.

Political risks and violence (14%) have moved up to the eighth position from the tenth, driven by ongoing conflicts in the Middle East and Ukraine and tensions between China and the US.

2024 is also a super-election year, where as much as 50% of the world’s population could go to the polls, including in India, Russia, the US, and the UK.

Dissatisfaction with the potential outcomes, coupled with general economic uncertainty, the high cost of living, and growing disinformation fueled by social media, means societal polarization is expected to increase, triggering more social unrest in many countries.

While Macroeconomic developments (19%) fall to the fifth position from the third, there is hope for economic stabilization in 2024, though growth outlooks remain subdued – just over 2% globally in 2024, according to Allianz Research.

“But this lackluster growth is a necessary evil: high inflation rates will finally be a thing of the past,” says Ludovic Subran, Chief Economist at Allianz. “This will give central banks some room to maneuver – lower interest rates are likely in the second half of the year. Not a second too late, as stimulus cannot be expected from fiscal policy. A caveat is the considerable number of elections in 2024 and the risk of further upheavals depending on certain outcomes.”

The shortage of skilled workforce (12%) drops to the tenth position globally but remains a top five business risk in Central and Eastern Europe, the UK, and Australia.

The survey emphasizes the critical role of IT and data experts in the fight against cybercrime, as they are the most challenging workforce to find.

Source: Allianz Risk Barometer 2024 by Allianz Global Corporate & Specialty (the full report can be found on the Allianz website) and The Loadstar.

P.S. Easy Freight Ltd helps New Zealand importers & exporters to save money on international freight and reduce mistakes by guiding how to comply with Customs and biosecurity rules.

➔ Contact us now to learn how we can assist you.