Global Air Cargo Activities are Declining while Air Passenger Traffic is Strong

3-minute read

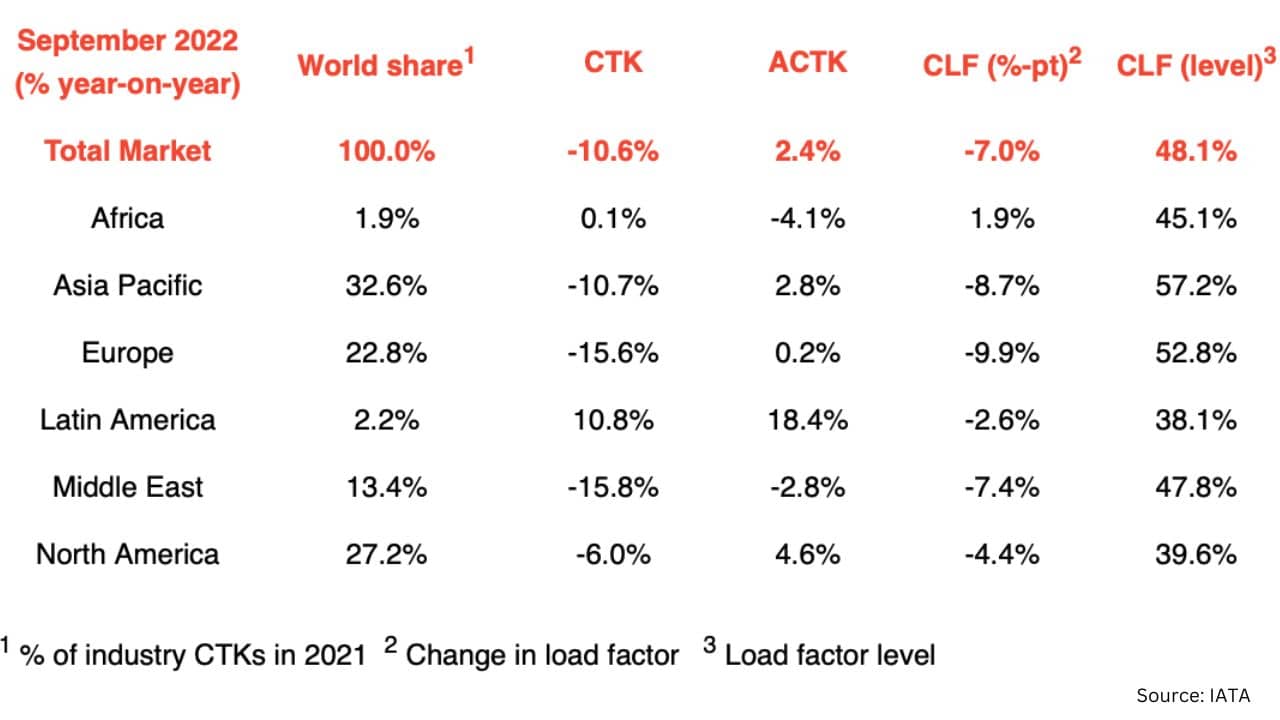

The International Air Transport Association (IATA) released data for September 2022 global air cargo markets showing that air cargo demand softened.

- Global demand, measured in cargo tonne-kilometers (CTKs*), fell 10.6% compared to September 2021 (-10.6% also for international operations), but continued to track at near pre-pandemic levels (-3.6%).

- Capacity was 2.4% above September 2021 (+5.0% for international operations) but still 7.4% below September 2019 levels (-8.1% for international operations).

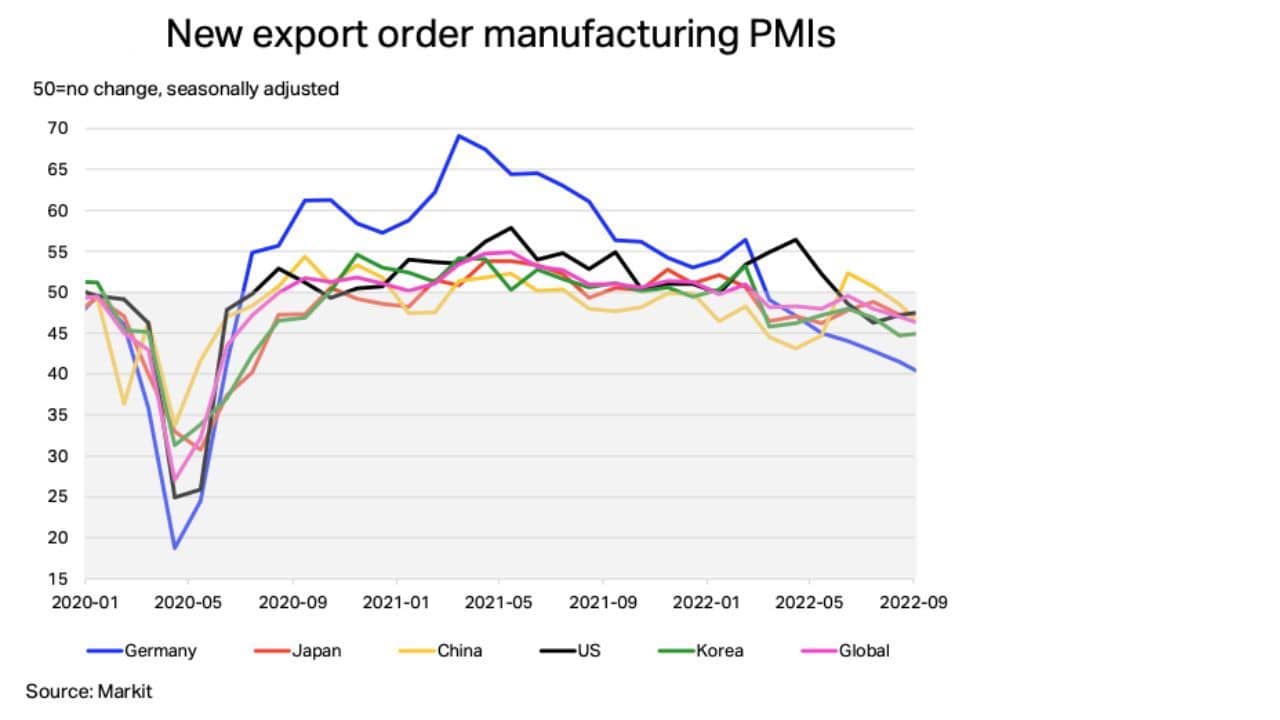

- International export demand remains weak. New export orders continue to shrink on a global level in September.

The softening air cargo demand is attributable to multiple headwinds. As most of the world’s regions recover from the pandemic, post-pandemic consumer spending habits are likely to lean towards vacation travel more than home shopping via e-commerce.

High inflation levels and the increasing fear of an economic recession have a negative impact on the global flows of goods and services. In addition, the ongoing war in Ukraine still affects cargo capacity, with a number of important air cargo carriers directly impacted.

Several factors in the operating environment should be noted

- Following contractions across major economies, the global Purchasing Managers Index (PMI) for new export orders also contracted (for a third month in a row) to its lowest level in two years.

The PMI of new export orders – historically a leading indicator for air cargo shipments – remained below the critical 50 line, suggesting continued contractions across the board.

The shrinking in international export demand extended into September for US, Japan and Korea.

Meanwhile, China contracted for a third month in a row, signalling the impact of the country’s Covid- related restrictions on air cargo activities.

Regarding Germany, the PMI decreased for the 7th consecutive month since March, marking the largest contraction since mid-2020.

- Latest global goods trade figures showed a 5.2% expansion in August, a positive sign for the global economy. This is expected to primarily benefit maritime cargo, with a slight boost to air cargo as well.

- Oil prices remained stable in September, and the jet fuel crack spread fell from a peak in June.

- The Consumer Price Index stabilized in G7 countries in September, but at a decade-high level of 7.7%. Inflation in producer (input) prices slowed to 13.7% in August.

“While air cargo’s activity continues to track near to 2019 levels, volumes remain below 2021’s exceptional performance as the industry faces some headwinds. At the consumer level, with travel restrictions lifting post-pandemic, people are likely to spend more on vacation travel and less on e-commerce. And at the macro-level, increasing recession warnings are likely to have a negative impact on the global flows of goods and services, balanced slightly by a stabilization of oil prices. Against this backdrop, air cargo is bearing up well. And a strategic slow-down in capacity growth from 6.3% in August to 2.4% in September demonstrates the flexibility the industry has in adjusting to economic developments,” said Willie Walsh, IATA’s Director General.

Regional Performance for Asia-Pacific

Asia-Pacific airlines saw their air cargo volumes decrease by 10.7% in September 2022 compared to the same month in 2021.

This was a decline in performance compared to August (-8.3%). Airlines in the region continue to be impacted by the conflict in Ukraine, labour shortages, and lower levels of trade and manufacturing activity due to Omicron-related restrictions in China.

Available capacity in the region increased by 2.8% compared to 2021.

Passenger Demand Stays Strong

The IATA also announced passenger data for September 2022, showing that the recovery in air travel continues to be strong.

Total traffic in September 2022 (measured in revenue passenger kilometers or RPKs) rose 57.0% compared to September 2021. Globally, traffic is now at 73.8% of September 2019 levels.

International traffic climbed 122.2% versus September 2021. September 2022 international RPKs reached 69.9% of September 2019 levels. All markets reported strong growth, led by Asia-Pacific.

“Even with economic and geopolitical uncertainties, the demand for air transport continues to recover ground. The outlier is still China with its pursuit of a zero COVID strategy keeping borders largely closed and creating a demand roller coaster ride for its domestic market, with September being down 46.4% on the previous year. That is in sharp contrast to the rest of Asia-Pacific, which, despite China’s dismal performance, posted a 464.8% increase for international traffic compared to the year-ago period,” said Willie Walsh, IATA’s Director General.

Source: IATA

P.S. Easy Freight Ltd helps New Zealand importers & exporters to save money on international freight and reduce mistakes by guiding how to comply with Customs and biosecurity rules.

➔ Contact us now to learn how we can assist you.