Ports of Auckland Profit is Down $5 mil and 50% of Ships Arrived Late

12-minute read

Ports of Auckland CEO, Tony Gibson has announced the company’s half-year results:

Our company is in the middle of a major investment programme which will increase capacity, efficiency and returns. This work will give us a solid foundation for a sustainable future, but while construction is underway there is a tangible effect on our business.

This and a number of other factors have combined to make the first half of this financial year difficult for Ports of Auckland.

The entire period has been clouded by the death of one of our colleagues in a straddle accident at the container terminal in August 2018. The accident was a terrible tragedy for a young man and his family and has impacted on all of us here at the port.

Many of our staff are still working through the recovery process and we are supporting them with that.

There is a Worksafe investigation underway into the cause of the accident which we expect to report later in 2019, and we have already implemented a number of changes designed to reduce the chance of any similar accidents occurring in future.

The accident also had a significant impact on our operations, because of when it happened and because we were already dealing with a number of factors which were making operations difficult.

It happened in the peak import season and volumes were higher than usual because of imports for the ‘Black Friday’ sales, a relatively new event in New Zealand.

We are in the middle of work to automate our container terminal, and terminal capacity is reduced while infrastructure upgrades take place.

The Auckland economy is booming and many businesses, including ours, are experiencing difficulty finding staff.

In addition, we are finding that a far higher proportion of ships are arriving late to port as a result of several factors including delays at ports overseas and weather.

In the last 12 months over half of the container ships arrived late. This creates bunching and extreme peak periods which add to congestion.

At the moment, there is no spare capacity at our container terminal, so even one unexpected event puts a strain on our resources. When several happen at the same time as they did last year, it becomes impossible.

As a result, we experienced severe congestion in September and October and had to divert a few services to other ports. We’d like to take this opportunity to thank our staff, who worked long hours in difficult circumstances to keep freight moving.

We’d also like to thank the importers, exporters, shipping lines, trucking companies and others for their help and patience as we worked to resolve the situation.

The September/October congestion also exposed the weakness of the Auckland supply chain: it is working at capacity, and small problems can rapidly escalate.

At its heart, Auckland’s growth means the supply chain needs to evolve if it is to handle the increased volumes which are now a permanent part of the landscape.

Some of the issues affecting the supply chain are the same as those experienced at the port: delays to shipping and labour shortages affecting the trucking industry.

The sector also faces road congestion in Auckland and a lack of capacity at nights and weekends in distribution centres, importers’ warehouses and empty container depots.

The solution is going to come through a combination of technology, greater co-ordination between supply-chain partners and a move to 24/7 working throughout the supply chain.

Ports of Auckland is working to update its processes and business rules to incentivise the necessary change.

As truck companies are often caught in the middle and sometimes unfairly blamed for the problems, we are working with National Road Carriers (NRC) to try to inform our supply chain partners about the issues and the changes that are needed.

As well as the services diverted during the congestion last year, service changes and further consolidation in the market have resulted in lower container volumes. We handled 485,093 TEU, down 4.6% compared to the same period last year (508,262 TEU).

We expect container volumes to be down for the full year. While total volumes were down, laden import volumes were up, in line with continued growth in Auckland.

While the severe congestion is now behind us, we will continue to operate with reduced terminal capacity until automation infrastructure works are completed later in 2019.

That will improve the situation, but we will still be operating a terminal at capacity until automation comes on stream early in 2020.

This will impact on our operations and on our ability to take greater volume, and that will be reflected in our results this year and the next.

On a positive note, we are pleased to report that work to increase capacity is proceeding well.

We have laid over 22 kilometres of fibre optic cable, installed 27 new light poles which also support the straddle positioning system, renewed 9.62 hectares of pavement, completed a new refrigerated container gantry, upgraded 23 truck lanes and undertaken just over 4,100 hours of automated straddle testing.

Over the next six months, we will complete construction of a new straddle refuelling and calibration area, start work on a pedestrian tunnel to allow access under a roadway used by automated straddles and start testing the straddles in operational situations.

Automation infrastructure work is on track for completion later in 2019. To avoid the risk of any repeat of last year’s congestion, a decision has been made to delay automation ‘go-live’ until early 2020, once the import peak and holiday seasons are over.

In October 2018 we took delivery of three new high productivity cranes, and work to commission them is well underway. The cranes are the first in New Zealand capable of remote operation and able to lift four containers at once.

They are larger than our existing cranes, able to operate on ships which can carry in excess of 11,000 TEU. Situated on our newest, deepest berth, these cranes future-proof the port for the arrival of larger ships, which will start to call at Auckland in the next few years.

We got a glimpse of this future in February 2019 with the arrival of the first container ship to use the new berth, which was also the first time we’ve been able to accommodate three large container ships at the terminal.

The crane commissioning process is expected to be complete around the middle of the year, after which the cranes will be used for automation testing before entering full service.

The new cranes, new berth and automation will together deliver a significant amount of extra capacity which is needed to cater for Auckland’s rapid population growth. We are expecting to be able to start to take full advantage of this new capacity around the middle of 2020.

Off-port, construction of the first customer facility at our Waikato Freight Hub has progressed well and is due to open in May.

This is a key part of our strategy to increase export volumes and improve the efficiency of the supply chain by balancing the flow of imports and exports through our port.

Work on the road connection over the main trunk rail line into the freight hub is also proceeding well and at the time of writing the beams for the new overbridge had just been put in place.

Non-containerised operations form a very important part of our business, and here too volumes were down.

A decline in car sales plus the impact of measures to prevent the introduction of the Brown Marmorated Stink Bug into the country have caused a fall in car volumes to 124,190 units, down 16.6% from 148,879 units in the previous corresponding period (pcp).

Car import volumes for the full year are expected to be lower than the previous financial year.

This reduction in car volumes is reflected in the total volume handled across our general cargo wharves (total volume includes cars, heavy vehicles and bulk goods such as cement). Volumes were down 4.7% to 3.253m tonnes, from 3.412m tonnes in the pcp.

The decline in volumes has affected port operations revenue which was down, although overall unaudited group revenue of $123.6m was up 2.5% on the pcp due to increased rental and other earnings.

Unaudited net profit after tax was $24.4m, down 16.4% on the pcp, as a result of increased operating costs including salary & wages, contracted services and fuel. Finance costs have also increased due to the current investment programme.

As noted, we expect our result for the full year to be lower than the previous financial year, and for the 2019/2020 year to also be affected.

In 2017 we developed a 30-year master plan which outlines how we can modify the current port to handle growth until such time as a new port is developed. The direction of the plan was supported by Auckland Council in May 2018, and we have proceeded to implement it.

In the past six months, we have demolished the old container cranes on Bledisloe Terminal to create more room for general cargo handling.

We also applied for and were granted consent for a car handling building at the south end of Bledisloe Terminal and construction is underway.

The building creates more space for handling cars and light commercial vehicles by going up rather than by going out. We will be using our land more intensively and eliminating the need for future reclamation.

Longer term, creating more space for vehicle handling in this way will enable the port to open up Captain Cook wharf – currently used for vehicles – for use by cruise ships.

The building will be a striking addition to the waterfront, as the western façade will be covered with 3,000 LED lights which can be used to create stunning visual displays.

The roof of the building will be specially strengthened to enable the future construction of a new downtown public park. Ports of Auckland is planning to begin consultation on the design of the park later in 2019.

The site works for the car handling building have started and it is expected to be complete by late 2020.

We have also applied to the Environmental Protection Agency for consent to dispose of dredged material at sea.

Dredged material is currently used in our Fergusson Terminal reclamation project, but given our commitment to end reclamation once this project is finished, the material will need to be disposed of elsewhere.

Disposal at sea in a designated disposal site over 150 kilometres from Auckland is currently the best option. We are awaiting a decision on this application.

Later this year, we will apply for consent to deepen the Waitematā Shipping Channel to accommodate larger container and cruise ships. This is an important component of our capacity enhancement work and supports our investment in automation and new cranes.

We are beginning consultation on this project prior to submitting a consent application.

Ports of Auckland has an ambitious goal to become a zero emissions port by 2040, and this year announced a significant milestone in that effort, the construction of Auckland’s first hydrogen production and refuelling facility.

The project is being undertaken in partnership with Auckland Transport, KiwiRail and Auckland Council.

We are currently seeking expressions of interest for the supply of the necessary hydrogen production and refuelling facility.

One of the new risks identified in recent years is the increased risk of cyber attack, particularly as we come to rely more heavily on technology. In response, we established a new Information Security (IS) team who have been reviewing and improving our systems.

More recently our IS team has created an operational technology (OT) monitoring capability that provides specialised detection of cyber security events within the automation network environments in preparation for the commissioning of the new quay cranes.

The OT capability complements other security platform upgrades and cyber tools such as advanced malware protection, increased internet perimeter protection and improved cloud security controls.

These capabilities combine to provide a three-hundred-and-sixty-degree view of our network. They are being incorporated into POAL’s Cyber Security Operations Centre (CSOC) in preparation for automation.

As a key first step in implementing our sustainability road map, in November this year, we received Diamond certification (the highest level) from Enviro-Mark Solutions for our Environmental Management System (EMS).

This is the first time we have sought formal certification for our EMS and it provided an opportunity for a comprehensive review of what we have in place and to bring together various environmental related management requirements under one management system.

Gaining the top level of certification at our first attempt is quite an achievement, and we would like to thank the team for completing this work.

In January we held the 6th annual SeePort Festival, a three-day open port event which is a celebration of New Zealand’s maritime industries.

The event gives us an opportunity to showcase our work and give the public a chance to see what goes on behind the port’s historic red fence.

It is also an opportunity for our maritime and supply chain partners – who include the Navy, KiwiRail, Customs and more – to engage with the public and show how we all work together to keep New Zealand supplied with the things we all want and need.

There were a number of new features this year, including crane tours (which were auctioned in support of Diabetes NZ – Auckland Branch), a 100-tonne KiwiRail locomotive on site and a virtual reality village.

The concert on the Sunday night was again a huge success, with an estimated 27,000 people attending. SeePort has become an Auckland institution, and we are finding that people are coming back each year to see what’s new.

Many of our staff volunteer to help at SeePort each year, and we would like to thank them for their help over a holiday weekend. We look forward to SeePort 2020!

On October 1st we sold the Port of Onehunga to Auckland Council, who bought the property for later development as part of their urban regeneration initiatives.

While the port has not handled freight for some time, this still marked the end of an era in Auckland, which no longer has a commercial port on each coast.

It could be seen as a culmination of the drift of international shipping to the calmer waters and population centres on the east coast of the country.

While we have sold Onehunga, we retain ownership of the old signal station and associated land on the South Head of Manukau Harbour. This land has special significance to the local community and particularly to the local iwi, Ngāti Te Ata a Waiohua.

The iwi’s connection with the land, known as Mahanihani, goes back centuries, and we were pleased to be able to help bring that connection to life again by facilitating the development of a historic walking trail.

On Waitangi Day 2019 we joined Ngāti Te Ata and other community members for a dawn blessing of the carved pouwhenua which mark stage one of the trail.

Ports of Auckland has also developed a planting restoration scheme for the land, which will preserve and enhance existing bush remnants on the site.

Planting work being done by port staff in partnership with the local community.

We continue to make a significant economic and social contribution to Auckland and New Zealand.

We have declared an interim dividend of $18.6 million to our owner, Auckland Council.

Over the last five years, Ports of Auckland has earned almost a quarter of a billion dollars for Auckland, money the city can use to help fund vital infrastructure projects and manage the cost of Auckland rates.

The next 18 months are not going to be easy. We believe there are significant risks to our business over the coming years from climate change, Auckland’s urbanisation and growth, cyber crime, and the international geo-political situation.

The work we have underway will help us address those risks, which is important for the sustainability of our operations and our ability to keep delivering to Aucklanders the freight they need.

The long-term benefits are clear and worth working for, but in the short term, it will be challenging.

We would like to thank all our staff and management for the work they are doing to prepare our port for a new era and to keep it operating at a high standard.

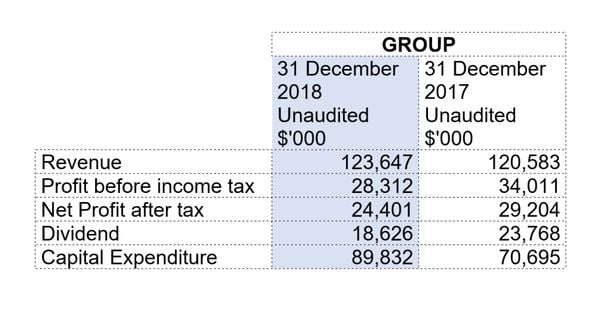

Financial performance

- Unaudited group revenue of $123.6m, up 2.5% on the previous corresponding period (pcp).

- Unaudited net profit after tax of $24.4m, down 16.4% on the pcp.

- Interim declared a dividend of $18.6m, compared to $23.8m for the pcp.

- Capital expenditure is up due to our investment in capacity growth. This is primarily automation and new cranes at our Waitematā seaport, plus a new road bridge and our first customer facility at our Waikato Freight Hub.

- Operating costs have increased due to lower volumes and productivity being impacted by work on the automation project.

For the six months ended 31 December 2018 Trading Performance

Trading Performance

- Container volume (TEU) of 485,093 down 4.6% (508,262 pcp).

- Total general cargo volume of 3.253m tonnes, down 4.7% (3.412m tonnes pcp).

- Car volume of 124,190 units, down 16.6% from 148,879 units in the pcp.

Source: Ports of Auckland

P.S. We’d love to answer any of your questions! Contact us. Do you know of other people that will find this article useful? Please share it on social media. Thank you!