Decline in Air Cargo Continues While Air Travel Grows

4-minute read

The International Air Transport Association (IATA) released data for March 2023 showing that global air cargo markets continue to decline against the previous year’s demand performance. This trend began in March 2022.

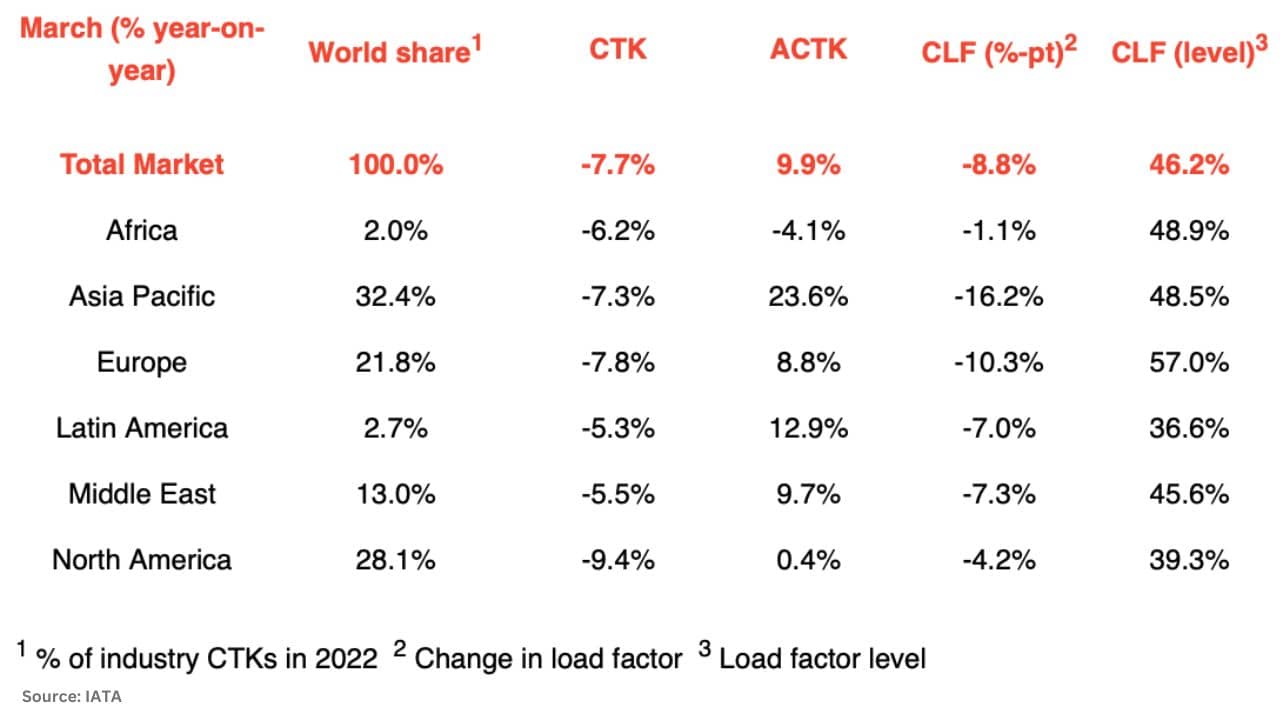

- Global air cargo demand decreased in March, with cargo tonne- kilometers (CTKs) falling by 7.7% year-on-year (YoY). This was a slight improvement over the previous February’s performance (-9.4%) and half the rate of annual decline seen in January and December (-16.8% and -15.6%, respectively).

- Air cargo capacity grew 9.9% YoY, primarily due to the increasing belly-hold capacity from passenger aircraft. As a result, cargo load factors fell to 46.2%, 8.8 percentage points (ppts) lower than last year’s load factors.

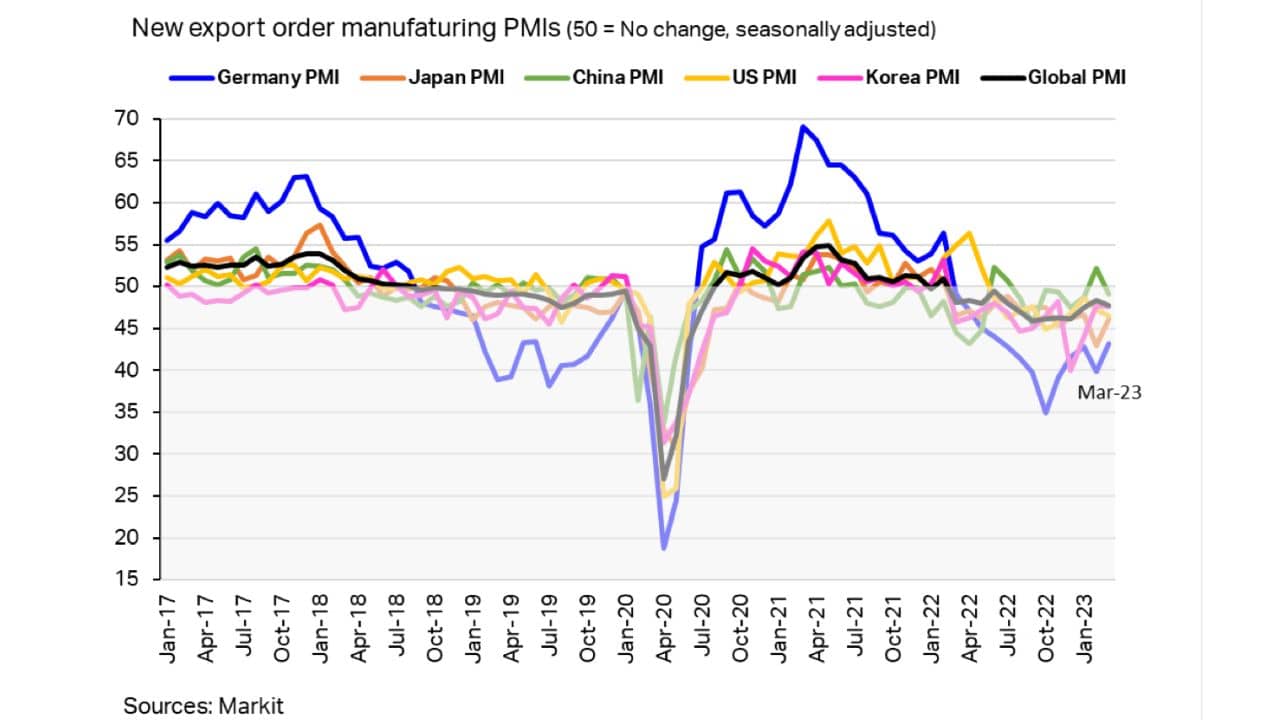

- The diminished strength of fundamental air cargo drivers, such as trade and manufacturing exports, continued to dampen potential gains in air cargo traffic as global new export orders remained weak for a full year.

- While China’s reopening has helped its economic outlook and cargo traffic on Asia Pacific trade lanes, its new export orders retreated in March after a slight improvement in February. Other major economies we track also saw contractions in their new export orders in March compared to February.

At this point, it is unclear if this is a potentially modest start of an improvement trend or the upside of market volatility. Irrespective of this, March’s performance slipped back into negative territory compared to pre-COVID levels (-8.1%).

- Several factors in the operating environment should be noted:

- Even with record-low unemployment rates, the global economy continues to decelerate due to a combination of factors such as tightening global financial conditions, high levels of global debt, and supply chain problems, including those linked to the war in Ukraine.

- In line with the weakening global trade, the Purchasing Manager Indices (PMIs) for new export orders at the global level remained below the 50-critical line for a full year as of March. China’s PMI retreated to below the 50-mark in March, following a slight improvement observed in February.

- The PMI for supplier delivery times indicates high inventory levels, which tends to have a negative impact on air cargo.

- Global goods trade decreased by 2.6% in February; this was a faster rate of decline than the previous month of -1.0%.

“Air cargo had a volatile first quarter. In March, overall demand slipped back below pre-COVID-19 levels and most of the indicators for the fundamental drivers of air cargo demand are weak or weakening. While the trading environment is tough, there is some good news. Airlines are getting help in managing through the volatility with yields that have remained high and fuel prices that have moderated from exceptionally high levels. Looking ahead, with inflation reducing in G7 countries policymakers are expected to ease economic cooling measures and that would stimulate demand,” said Willie Walsh, IATA’s Director General.

March Regional Performance for Asia-Pacific

- Asia-Pacific airlines saw their air cargo volumes decrease by 7.3% in March 2023 compared to the same month in 2022. This was a slight decrease in performance compared to February (-5.4%).

The drop in demand suggests that air cargo traffic in the region has not yet stabilized following China’s reopening in January. Available capacity in the region increased by 23.6% compared to March 2022 as more belly capacity came online from the passenger side of the business.

Meanwhile, IATA announced strong demand growth in air travel for March 2023.

“The calendar year first quarter ended on a strong note for air travel demand. Domestic markets have been near their pre-pandemic levels for months. And for international travel two key waypoints were topped. First, demand increased by 3.5 percentage points compared to the previous month’s growth, to reach 81.6% of pre-COVID levels. This was led by a near-tripling of demand for Asia-Pacific carriers as China’s re-opening took hold. And efficiency is improving as international load factors reached 81.3%. Even more importantly, ticket sales for both domestic and international travel give every indication that strong growth will continue into the peak Northern Hemisphere summer travel season,” said Willie Walsh, IATA’s Director General.

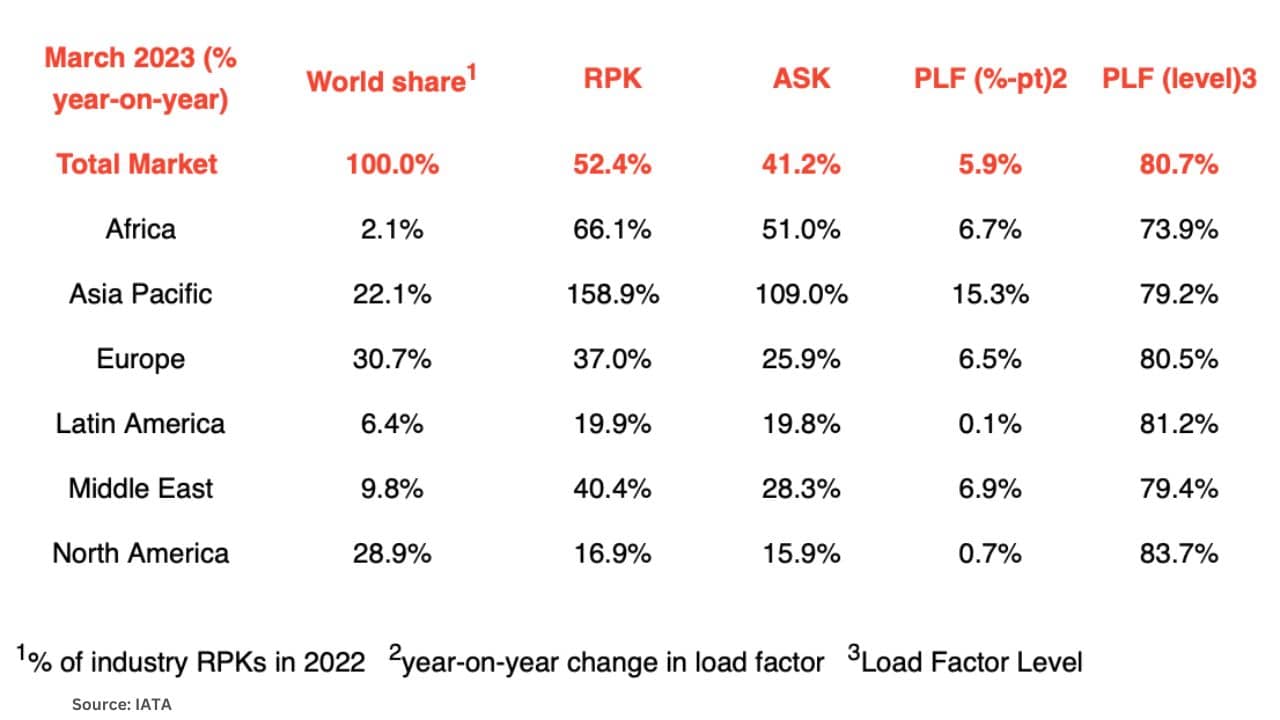

- Global passenger traffic exhibited strong growth in March, with industry-wide revenue passenger-kilometers (RPKs) increasing by 52.4% year-on-year (YoY) and reaching 88.0% of March 2019 levels.

- Domestic RPKs were almost fully recovered, only 1.1% below pre-pandemic levels after growing 34.1% YoY.

- The annual growth in international RPKs was 68.9%, demonstrating resilient demand for air travel. International load factors also climbed to 80.7%, slightly higher than their pre-pandemic level.

- The reopening of China and the easing of travel restrictions has accelerated the recovery of domestic and international traffic. Asia Pacific carriers experienced the fastest annual growth in total RPKs at 158.9%, with a significant increase in international passengers between the region and the rest of the world.

“As traveller expectations build towards the peak Northern Hemisphere summer travel season, airlines are doing their best to meet the desire and need to fly. Unfortunately, a lack of capacity means that some of those travellers may be disappointed. Part of this capacity shortfall is attributable to the widely reported labor shortages impacting many parts of the aviation value chain, as well as supply chain issues affecting the aircraft manufacturing sector that is resulting in aircraft delivery delays. However, a significant share of recent flight cancellations, primarily in Europe, are owing to job actions by air traffic controllers and others. These irresponsible actions resulted in thousands of unnecessary cancellations in March. This is unacceptable and should not be tolerated by the authorities,” said Walsh.

Source: IATA

P.S. Easy Freight Ltd helps New Zealand importers & exporters to save money on international freight and reduce mistakes by guiding how to comply with Customs and biosecurity rules.

➔ Contact us now to learn how we can assist you.