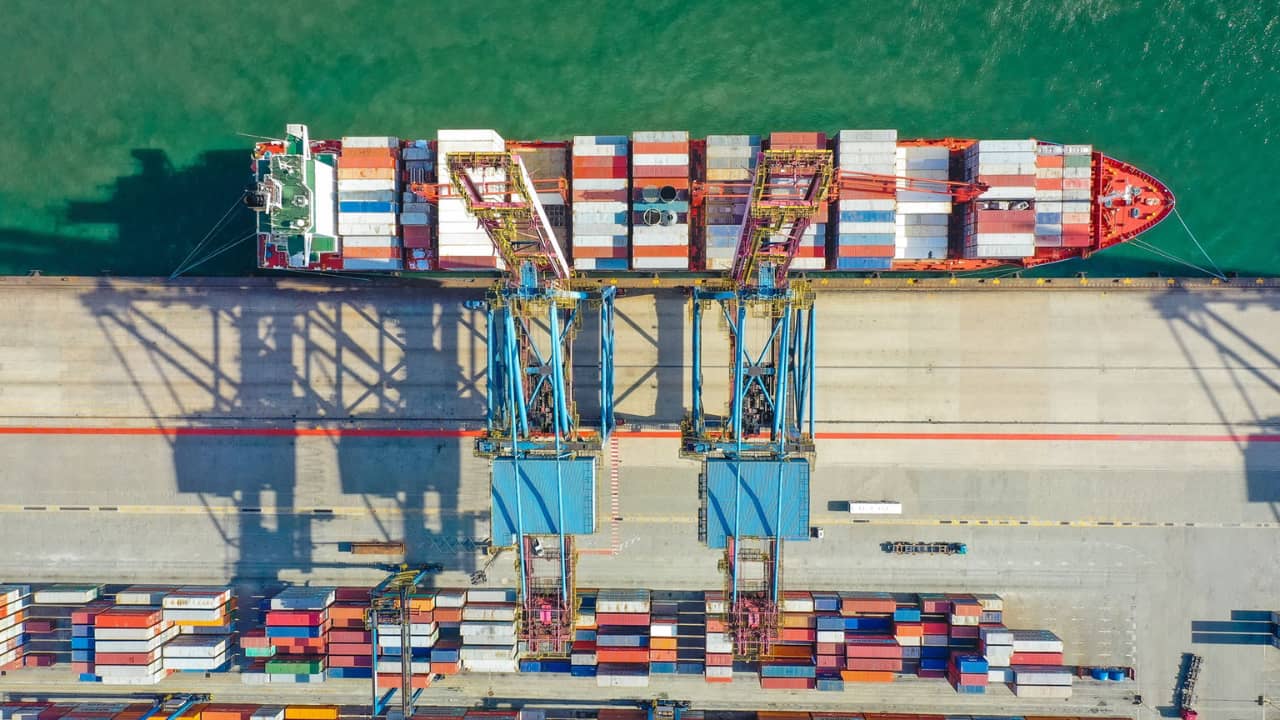

Global Container Shortage a Threat to Importers & Exporters

5-minute read

Consumers and businesses will be facing shortages over Christmas after major shipping lines halted new bookings from Asia on record global demand and the impacts of ongoing disruption at trans-Tasman ports.

With demand for shipping space at all-time highs in some cases, and as much as 25% up on the same period last year, congestion has become a major theme at most global ports.

That is being exacerbated by rolling industrial action at Australian entry points like Sydney and by loading delays at Ports of Auckland.

That has spilled over into cancellations by major shipping lines and a slowdown of NZ imports from China, as well as the imposition of congestion charges of up to US$300 per twenty-foot-equivalent unit (TEU) on top of already higher seasonal rates charged to importers.

That will almost certainly see less stock on retail shelves and increase costs over the busy Christmas period and beyond as importers offset costs to consumers, said Katherine Rich, chief executive of the NZ Food and Grocery Council.

Nico Hecker, a director of global container logistics at German-based shipping and container group Hapag-Lloyd, said while demand in the second quarter was low due to the impacts of the pandemic – with about 600,000 twenty-foot equivalent units empty on the ground – demand for equipment had now increased tremendously, and the 350,000 TEUs sitting on ground are “hardly covering two weeks of global export volumes.”

Hapag-Lloyd, which is levying a US$250/TEU congestion charge into Auckland, said three of every four containers in its 40-ft fleet are currently deployed and therefore not available.

Hecker said those containers “must be returned to China as quickly as possible to be equipped for an expected strong fourth quarter.”

In some cases, shipping companies were also known to be using ‘sweeper vessels’ to pick up containers around the world to return to Asia.

Unexpected Resurgence

Rosemarie Dawson, executive director of the Customs Brokers and Freight Forwarders Federation of NZ, said it’s clear shipping companies were caught “flat-footed” by surging consumer spending after reducing capacity. That is a scenario that “could well last until at least the middle of next year.”

She said it is already difficult to get space on vessels coming out of China, but with bookings now being rolled, often over several weeks, carriers are reporting “drastically reduced” new bookings so they can catch up with containers sitting at trans-shipment hubs.

And she suggested the situation is expected to “only get worse” on the back of a surge in import and export volumes, as well as delays and congestion at the Ports of Auckland in particular.

KiwiRail is also inundated, and has been cited by the ports for its inability to speed up transport volumes to and from Auckland and the Port of Tauranga.

Group chief executive Greg Miller told BusinessDesk that the Auckland container terminal at Southdown had already been running at capacity for a number of weeks, but the railway was working closely with both importers and exporters to work through the congestion.

While admitting work on the Auckland commuter network had caused some delays, he said that wasn’t affecting the frequency of trains, which extended to 39 return freight services between the two cities weekly.

This provides a combined capacity of more than 4,100 twenty-foot equivalent units in each direction. “And each of these trains is running at capacity.”

Container Shortages

But it is the critical shortage of shipping containers globally – due to delayed container returns – that is of most concern to exporters.

David Ross is chief executive of Kotahi, which at 300,000 TEUs per year represents almost a third of NZ’s containerised exports.

While the export supply chain had performed well over the covid lockdown period, he said it was “inevitable” the flow of containers in and around NZ will start impacting NZ exports as shipping lines adjust their vessel itineraries to manage capacity and congestion.

That has already seen a 15 percent drop in on-time performance over the past quarter, he said, and “that’s big.”

He said at its base level, the world has “definitely started trading again in a big way” as people spend money on consumable traded items, and this was compounded by a lack of air trade and with US President Donald Trump’s China trade restrictions also coming into play.

“So those issues are driving really high levels of global trade, to the point where there is no idle fleet capacity left, meaning every container ship that can carry containers is in play at the moment.”

But with supply still not able to keep up with demand, particularly in big trade lanes like China-US, that has also seen significant increases in average spot freight rates during what would normally be a traditional slowdown period out of Asia.

As a result the Shanghai Shipping Exchange’s containerised freight index for Australia/NZ has shot up 6.3 percent since the end of October.

But Food Exports Are Up

Kotahi expects to manage about 30,000 TEUs of NZ export volumes this month across a range of bulk and finished food products, or about a fifth more than last year.

Ross said the challenge now is to manage current strong export demand for dairy products.

In that case, he said it was “fortunate” to have a 10-year strategic partnership in place with Maersk, so the exporter has been able to access sources of containers.

“We are confident that we will be able to get all our cargo to export markets, but it’s thin even for us, and I think there will be others who may struggle.”

In the meantime, Dawson said the Chinese New Year could provide the ‘circuit breaker’ the supply chain needs to catch up, reflected in an increase in capacity around March or April when shipping lines usually put more ships on for the stone fruit season.

Road Transport Forum chief executive Nick Leggett said the freight industry was “well aware” of the delays to global freight and the trucking industry was “used to adjusting to freight peaks, particularly at Christmas.”

However, he said some will inevitably miss out on what they want for Christmas and there will be others who “might have to pay more than they thought they would.”

“Given the government’s lack of understanding about the supply chain, we just have to get on and find solutions,” he told BusinessDesk.

“Moving freight globally is getting very expensive and there are going to be some serious flow-on effects for New Zealand as the country attempts to embark on big housing and infrastructure projects that require imported components.”

P.S. Easy Freight Ltd helps New Zealand importers & exporters to save money on international freight and reduce mistakes by guiding how to comply with Customs and biosecurity rules.

➔ Contact us now to learn how we can assist you.