Tips on Importing Goods Into New Zealand

4-minute read

This information is to help people understand the collection of Customs tariff duties, plus goods and services tax (GST), on articles imported into New Zealand.

It explains how Customs tariff duty is charged on goods imported into New Zealand, lists a number of concessions, and describes which goods are subject to strict import control, or are absolutely prohibited.

WHAT GOODS WILL I PAY TARIFF DUTY ON?

As a general rule, goods of a type not manufactured in this country are free of tariff duty. Items such as clothing and footwear which are produced domestically attract relatively high rates of tariff duty.

If applicable, tariff duty is charged on the transaction value of the imported goods, ie, the price actually paid for them.

Where there is no identifiable value declared, such as in the case of a gift, the value will still need to be determined.

You can visit What’s My Duty? website to estimate how much import duty and/or GST you may need to pay to New Zealand Customs.

DO I PAY GOODS AND SERVICES TAX (GST)?

In addition to the tariff duty payable on certain goods, GST is charged on all imported goods, even though the entire transaction, including payment, may have been conducted offshore.

GST is calculated on the Customs value of the item plus tariff duty (note: some goods have no tariff duty), plus any freight and insurance costs incurred in bringing the goods to New Zealand.

MINIMUM DUTY COLLECTABLE

Customs does not collect tariff duty and GST where the total payable (tariff duty plus GST combined) on any one importation is less than $60.

Note: This provision does not apply to alcohol or tobacco products.

DO CUSTOMS TARIFF DUTY AND GST CHARGES APPLY TO MAIL ORDER OR INTERNET IMPORTATIONS?

Yes! There are no provisions to exempt such importations from tariff duty and GST.

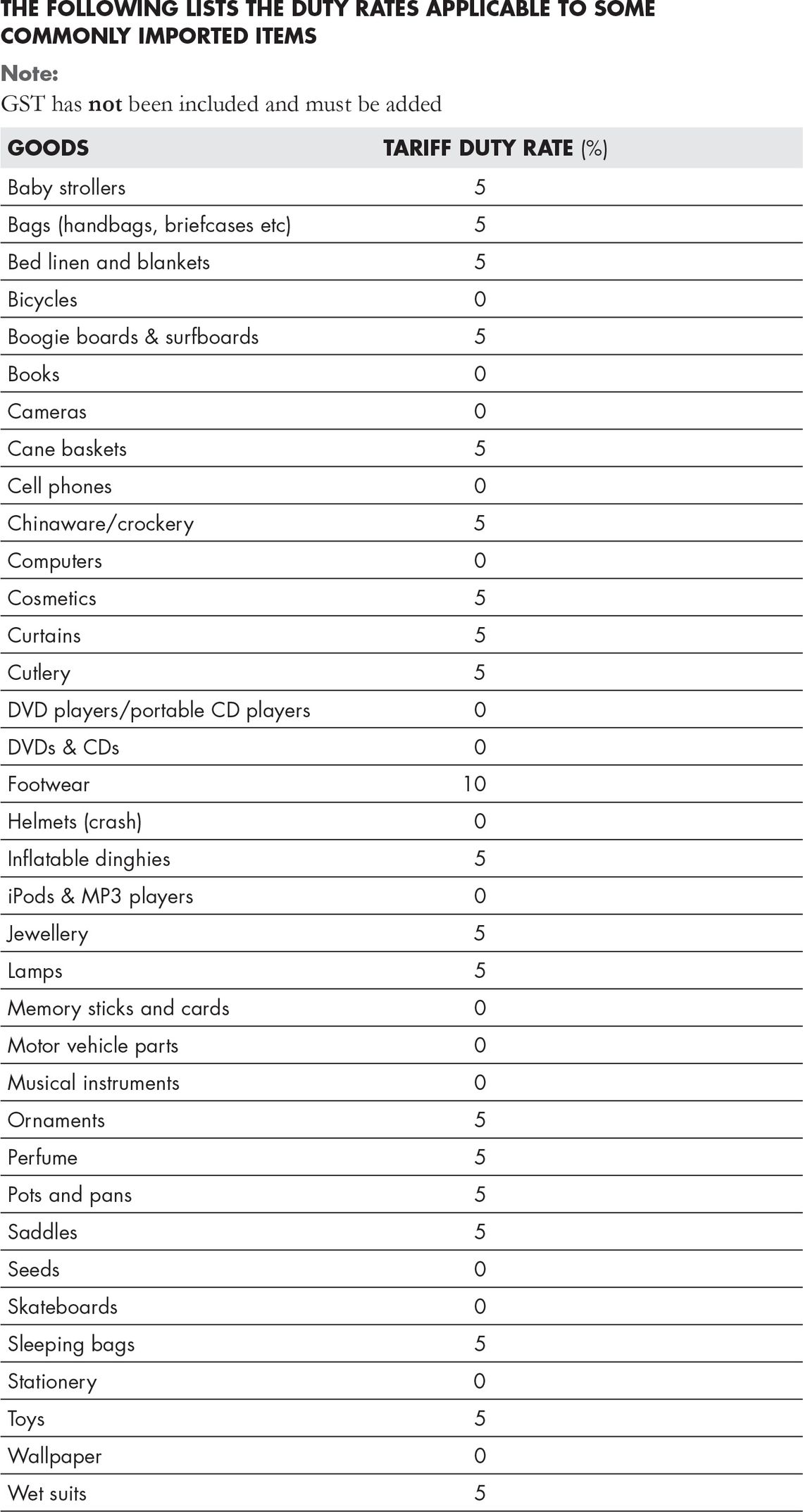

WHAT ARE THE CUSTOMS TARIFF DUTY RATES?

The below list shows the tariff duty rates payable on the most common goods likely to be purchased overseas by travellers or purchased via mail order or the internet.

It is not designed to serve as a substitute for the Working Tariff of New Zealand document and, because the rates shown are subject to change, there is no guarantee that they will apply at the time the goods arrive in New Zealand.

ARE THERE ANY OTHER FEES PAYABLE?

Where Customs requires that a person enter their goods on an electronic entry an Import Entry Transaction Fee (IETF) may be charged. The IETF is $25.30 (including GST).

In addition a biosecurity levy of $12.77 is collected by Customs on behalf of the Ministry for Primary Industries (MPI).

This levy will be charged on all imports that attract the IETF. The funds collected by Customs from the levy are paid to MPI.

WHAT CONCESSIONS AND ALLOWANCES MAY APPLY?

There are various concessions and allowances that serve to either reduce, or waive, the Customs tariff duties payable on imported goods.

Although the concession may waive duty, GST is still payable. An IETF, and MPI levy, as noted above, may also still be charged.

Personal effects

Wearing apparel, clothing, footwear etc, purchased by a New Zealand resident (traveller) while on an overseas trip will be admitted free, by way of concession of all Customs tariff duties and GST, provided that the goods are intended for the private use of that traveller and are not intended for any other person or persons or for gift, sale, or exchange.

The concession applies to both accompanied and unaccompanied personal effects.

The personal effects do not have to be worn or used to qualify for duty free admission, but you will need to establish that the purchase was made during the course of the overseas visit.

Note: This concession does not apply to clothing, footwear etc, purchased by mail order or via the internet from New Zealand.

Gifts

Unsolicited gifts sent from persons abroad to persons resident in New Zealand are not automatically free of Customs tariff duties and GST.

- A gift sent to an individual with a declared value of NZ$110 or less is allowed free entry.

- Gifts with a declared value that is higher than NZ$110 attract Customs tariff duty and GST on the value in excess of NZ$110.

Gift parcels consisting of multiple gifts for individual persons will be allowed the gift concession provided that the individual gift and the identity of the recipient can be established.

A single gift article cannot be shared by more than one person, ie, only one gift concession of $110 may be claimed per article.

Alcohol and tobacco products may be allowed under the gift concession provided that the recipient (of the goods) is able to prove that they are a genuine gift, ie, intended to celebrate a specific occasion and are not part of a repetitive import pattern designed to avoid payment of tariff duty and GST.

For further information please contact our office.

Question: Have you ever been affected by any of the issues above? Do you have any other questions? Share your experience in the comments box below.

P.S. Do you know of other people that will find this article useful? Awesome, please share it on social media. Thank you!