How to Get Paid

4-minute read

Both buyers and sellers need to determine the risk to their own business, the amount they are willing to pay to mitigate that risk. There are four commonly used payment methods for reducing these risks.

1. ADVANCE PAYMENTS

Buyer pays for the goods prior to shipment.

With this payment method, the exporter can avoid credit risk, since payment is received prior to the transfer of ownership of the goods.

However, requiring payment in advance is the least attractive option for the buyer, as this method creates cash flow problems.

Foreign buyers are also concerned that the goods may not be sent if payment is made in advance.

Thus, exporters that insist on this method of payment may find themselves losing out to competitors who may be willing to offer more attractive payment terms.

It may be possible to negotiate a partial payment upfront with the remainder paid via another method. If you are exporting a service you may be able to get paid in instalments once key milestones are met.

2. OPEN ACCOUNT

Buyer pays for the goods after shipment or receipt.

An open account transaction means that the goods are shipped and delivered before payment is due.

Obviously, this is the most advantageous option to the importer in cash flow and cost terms, but it is consequently the highest risk option for an exporter.

This payment method is typically used by companies that have an ongoing relationship because of the required trustworthiness required by both parties.

The buyer will pay for goods after they have been received or on a regular invoice cycle agreed between both parties (for example, on the 2oth of the month or 90 days after shipment).

With an open account, the seller bears all of the risk of non-payment.

Along with price, quality and expertise, the ability to offer customers credit has become an increasingly competitive factor in international trade.

If you can offer attractive credit terms you may stand a better chance of securing the deal.

Private credit insurance companies can provide short-term trade credit insurance for many markets and credit-worthy clients worldwide.

However, if you are exporting to riskier countries, or your buyer is seeking finance terms beyond 12 months, then consider contacting the New Zealand Export Credit Office.

3. DOCUMENTARY COLLECTIONS

Banks are involved in handling the transfer of documents from seller to buyer.

Documentary collections use a bank as an intermediary between the seller and the buyer. The seller provides shipping documents to the buyer’s bank which then releases the documents to the buyer.

When these are released depends on the agreement between the buyer and seller, and may be:

- On Sight Collections-once the buyer has paid for them.

- On Term Collections -once the buyer has signed an agreement to pay for them in future.

The purpose of this is to restrict the buyer’s access to the goods until they have either paid for them or given some legally binding promise to pay for them.

However, the buyer’s bank does not offer any guarantee that the buyer will pay/accept the documents.

The buyer may obtain possession of goods and clear them through customs, if the buyer has the shipping documents such as original bill of lading, certificate of origin, etc.

However, the documents are only given to the buyer after payment has been made (“Documents against Payment”) or payment undertaking has been given – the buyer has accepted a bill of exchange issued by the seller and payable at a certain date in the future (maturity date) (“Documents against Acceptance”).

This payment method make easy import-export operations within low cost.

But it does not provide same level of protection as the letter of credit (see payment method number 4) as it does not involve any kind of bank guarantee like letter of credit.

Documentary collections are known by a range of other names including Collections, Cash against Documents (CAD), Documents against Payment (D/P), Documents against Acceptance (D/A), and Bills of Exchange.

4. DOCUMENTARY CREDITS

Banks are involved in handling the transfer of documents from seller to buyer and also guarantee payment to the seller.

These the among the most secure instruments available to international traders. Documentary Credits are also known as Letters of Credit, LCs or DCs.

An LC is a commitment by a bank on behalf of the buyer that payment will be made to the exporter provided that the terms and conditions have been met, as verified through the presentation of all required documents.

An LC also protects the buyer since no payment obligation arises until the goods have been shipped or delivered as promised.

The documentary credit will specify what documents are required and any other terms and conditions (for example, an expiry date for the agreement).

When determining the most appropriate method payment, it is important to keep in mind the disadvantage to the counterparty, as well as to your own business.

If you are asking your business partner to accept a risk, they are likely to expect this to be offset with more favourable pricing or other benefits to their company.

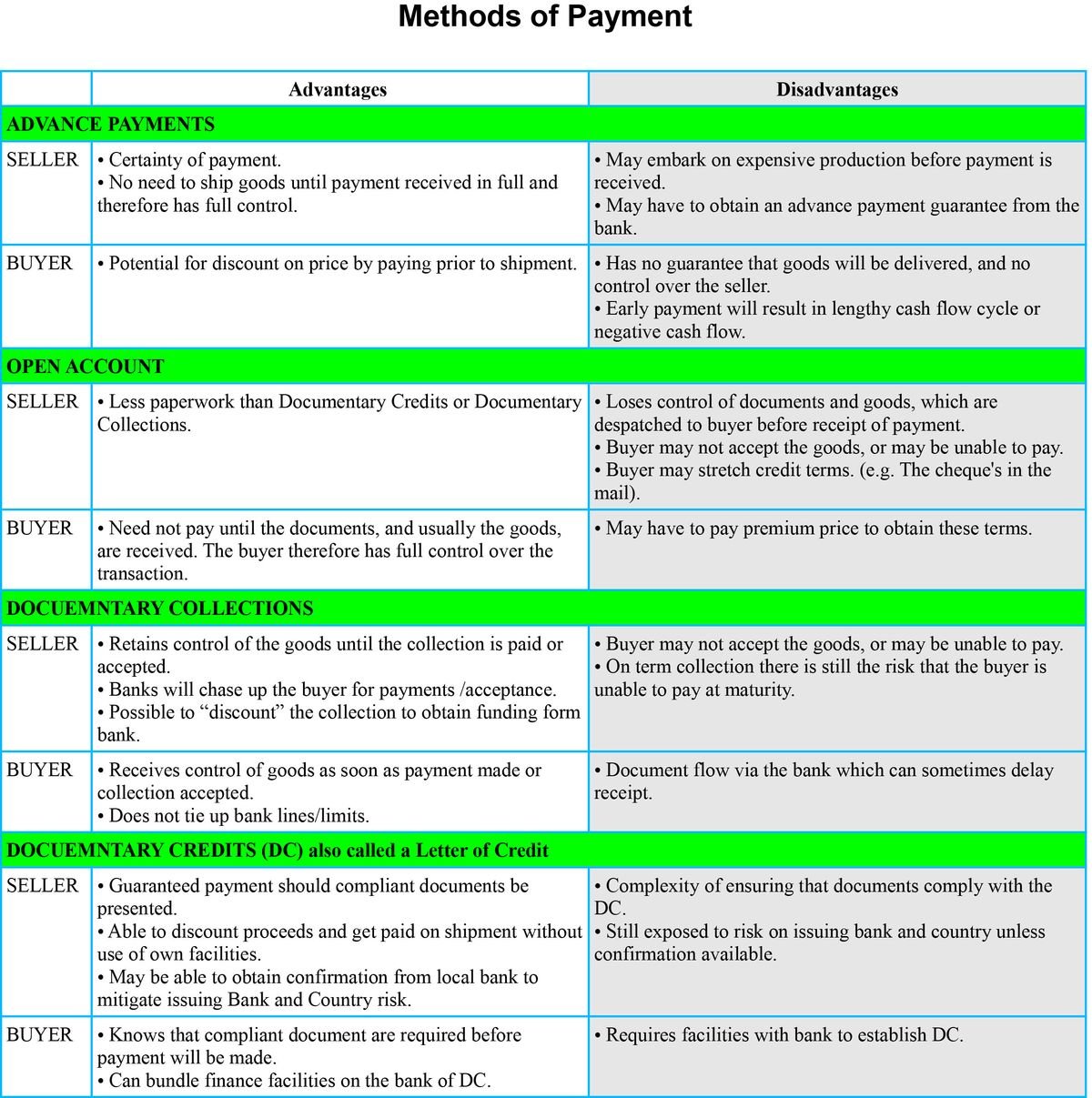

The table below shows the advantages and disadvantages for both buyers and sellers of the four options outlined above (Click on the image to view full size).

CREDIT CHECKS

When you receive your first export order, conduct the same credit checks you would with any new customer in New Zealand.

As part of your credit application process ask for credit references, preferably from New Zealand suppliers, and follow these up.

Once you are satisfied with a customer’s creditworthiness, establish clear payment terms in advance of the deal.

Government agencies, legal and accounting firms, and credit agencies can assist you in confirming the bona fides of inquirers and potential partners/customers.

Contact us today to find out how we can help you to select the correct method of payment.